Chapter 2 Classical Theory of Simple Linear Regression

2.1 Review

We will need several facts and techniques from MATH/STAT 3850 that you may or may not remember. The most important theory for this chapter is that related to normal random variables.

Recall, a normal random variable with mean \(\mu\) and standard deviation \(\sigma\) has pdf given by

\[

f(x) = \frac {1}{\sqrt{2\pi}\sigma} e^{-(x- \mu)^2/(2\sigma^2)}

\]

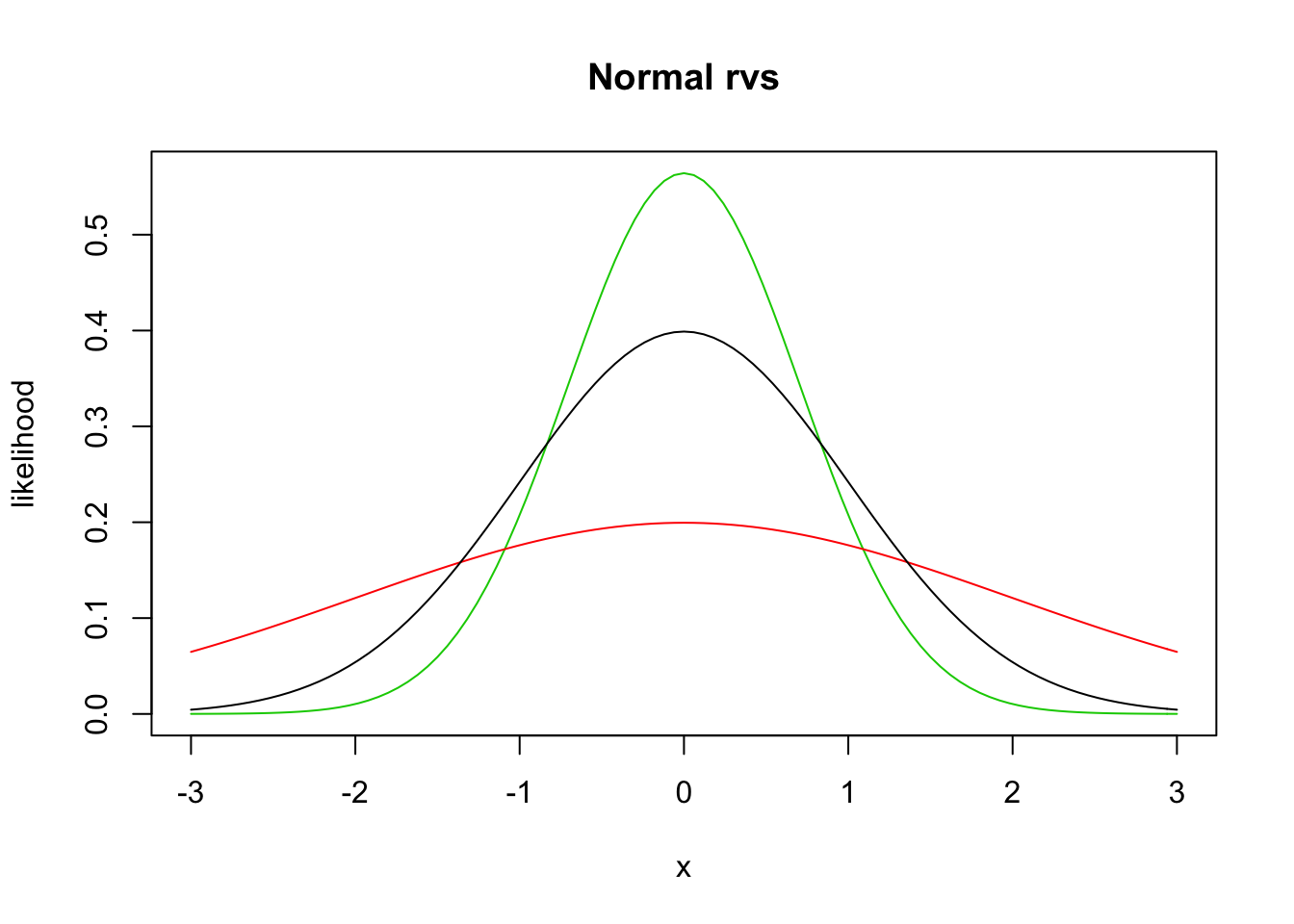

We will not work much with the pdf directly, but rather use the built in R function dnorm, which has usage dnorm(x, mu, sigma). Let’s look at a couple of plots of pdfs of normal random variables.

curve(dnorm(x, 0, 1/sqrt(2)), from = -3, to = 3, col = 3,

main = "Normal rvs",

ylab = "likelihood") #green

curve(dnorm(x, 0, 2), add= T, col = 2) #red

curve(dnorm(x, 0, 1), add = T, col = 1) #black

Recall that the area under the curve between \(x = a\) and \(x = b\) of the pdf of \(X\) gives \(P(a \le X \le b) = \int_a^b f(x)\, dx\). Probability density functions can also be used to find the expected value of a random variable \(X\) via \[ \mu_X = E[X] = \int_{-\infty}^\infty x f(x)\, dx. \]

Theorem 2.1 Key facts about normal random variables.

If \(X_1\) and \(X_2\) are independent normal random variables with means \(\mu_1, \mu_2\) and standard deviations \(\sigma_1, \sigma_2\), then \(X_1 + X_2\) is normal with mean \(\mu_1 + \mu_2\) and standard deviation \(\sqrt{\sigma_1^2 + \sigma_2^2}\). if

If \(X \sim N(\mu, \sigma)\) and \(a\) is a real number, then \(X + a \sim N(\mu + a, \sigma)\).

If \(X \sim N(\mu, \sigma)\) and \(a\) is a real number, then \(aX \sim N(a\mu, a\sigma)\).

The key things to remember are that the sum of independent normals is again normal, and that translating or scaling a normal is still normal. The means and standard deviations of the resulting random variables can be computed from general facts about sums of rvs, given below.

Theorem 2.2 The following are facts about expected values of rvs.

\(E[X + Y] = E[X] + E[Y]\), whether \(X\) and \(Y\) are independent or dependent!

\(E[a] = a\).

\(E[aX] = aE[X]\).

\(E[\sum_{i = 1}^n a_i X_i] = \sum_{i = 1}^n a_i E[X_i]\).

Recall that the variance of an rv is \(V(X) = E[(X - \mu)^2] = E[X^2] - \mu^2\), and that the standard deviation is the square root of the variance.

Theorem 2.3 Here are some key facts about variances of rvs.

\(V(aX) = a^2 V(X)\)

\(V(\sum_{i = 1}^n a_i X_i) = \sum_{i = 1}^n a_i^2 V(X_i)\), provided that the random variables are independent!

\(V(a) = 0\)

The other key thing that you will need to remember is about simulations. We will be doing quite a bit of simulation work in this chapter.

2.1.1 Estimating Means and standard deviations

Let’s recall how we can estimate the mean of a random variable given a random sample from that rv. Recall that r + root is the way that we can get random samples from known distributions. Here, we estimate the mean of a normal rv with mean 1 and standard deviation 2. Obviously, we hope to get approximately 1.

We first get a single sample from the rv, then we put it inside replicate.

## [1] 0.8470431This creates a vector of length 10000 that is a random sample from a normal rv with mean 1 and sd 2. For simple examples like this, it would be more natural to do sim_data <- rnorm(10000, 1, 2), but the above will be easier to keep track of when we get to more complicated things, imho.

Next, we just take the mean (average) of the random sample.

## [1] 0.9988018And we see that we get pretty close to 1. Let’s verify that \(2 *X + 3 * Y\) has mean \(2\mu_X + 3 \mu_Y\) in the case that \(X\) and \(Y\) are normal with means 2 and 5 respectively.

x <- rnorm(1, 2, 1) #chose sd = 1

y <- rnorm(1, 5, 3) #chose different sd just to see if that matters

2 * x + 3 * y## [1] 9.747763That is one sample from \(2X + 3Y\). Let’s get a lot of samples.

sim_data <- replicate(10000, {

x <- rnorm(1, 2, 1) #chose sd = 1

y <- rnorm(1, 5, 3) #chose different sd just to see if that matters

2 * x + 3 * y

})

mean(sim_data)## [1] 18.84581## [1] 19We compare the estimated mean to the true mean of 19, and see that we are pretty close. To be sure, we might run the simulation a couple of times and see whether it looks like it is staying close to 19; sometimes larger, sometimes smaller.

To estimate the variance of an rv, we take a large sample and use the R function var, which computes the sample variance. This is not as straightorward from a theoretical standpoint as taking the mean, but we will ignore the difficulties. We know from Theorem 2.3 that the variance of \(2X + 3Y\) shoule be \(4 * 1 + 9 * 9 = 85\). Let’s check it out. We already have built our random sample, so we just use var on that.

## [1] 86.57403Let’s repeat a few times.

sim_data <- replicate(10000, {

x <- rnorm(1, 2, 1) #chose sd = 1

y <- rnorm(1, 5, 3) #chose different sd just to see if that matters

2 * x + 3 * y

})

var(sim_data)## [1] 87.24217Seems to be working. To estimate the standard deviation, we would take the square root, or use the sd R function.

## [1] 9.340352## [1] 9.340352## [1] 9.219544The reason it is tricky from a theoretical point of view to estimate the standard deviation is that, if you repeated the above a bunch of times, you would notice that sd is slighlty off on average. But, the variance is correct, on average.

2.1.2 Estimating the density of an rv

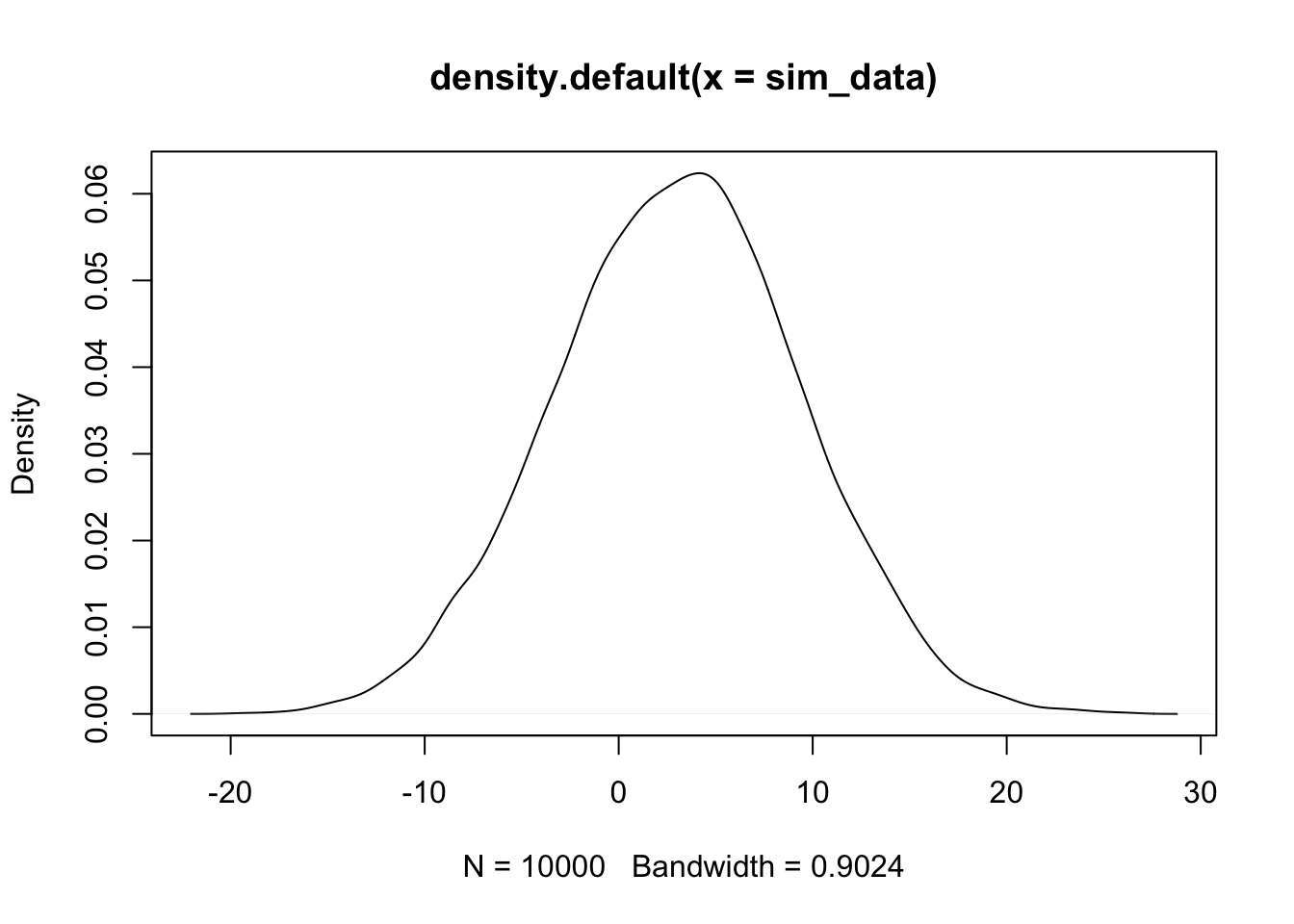

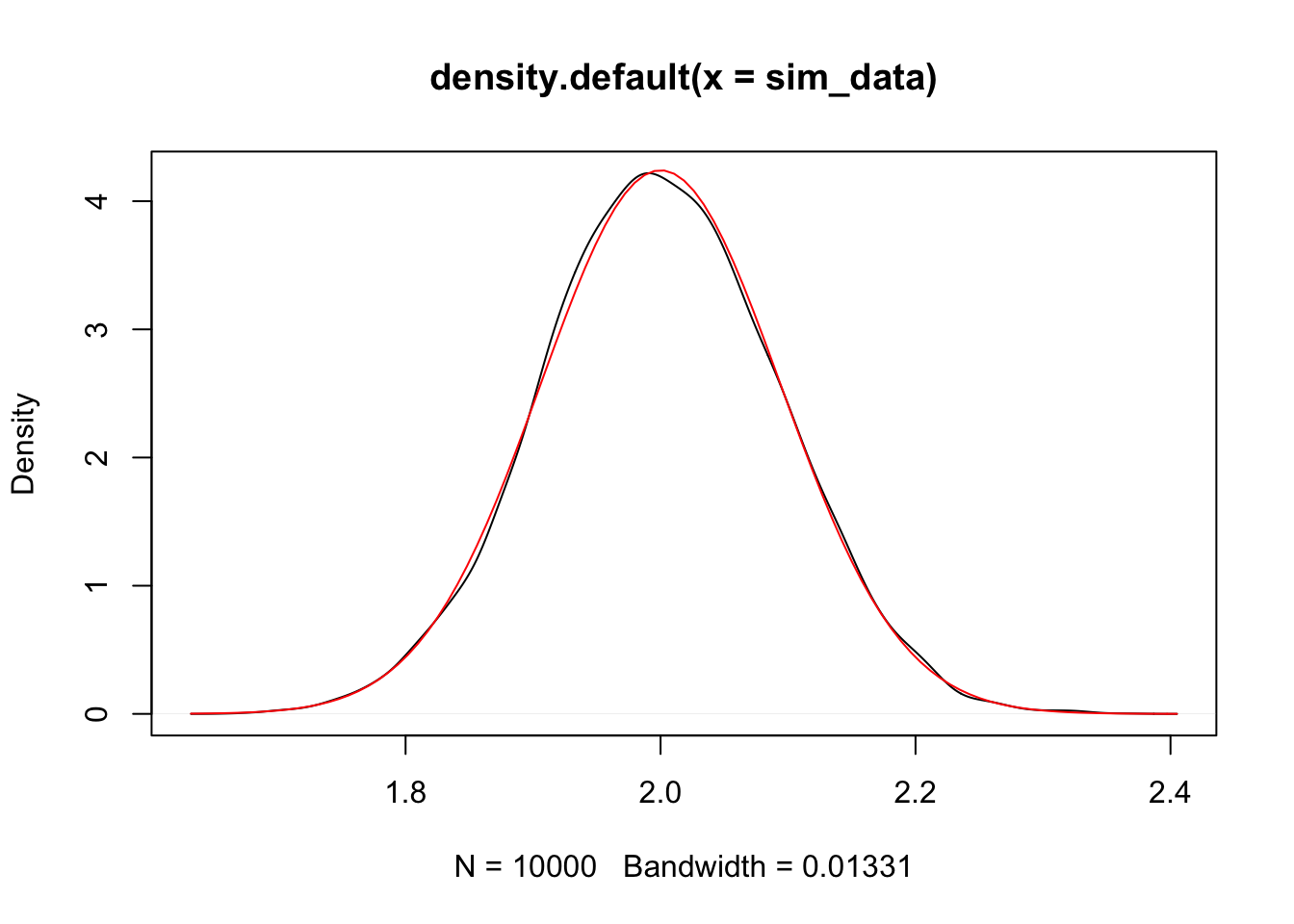

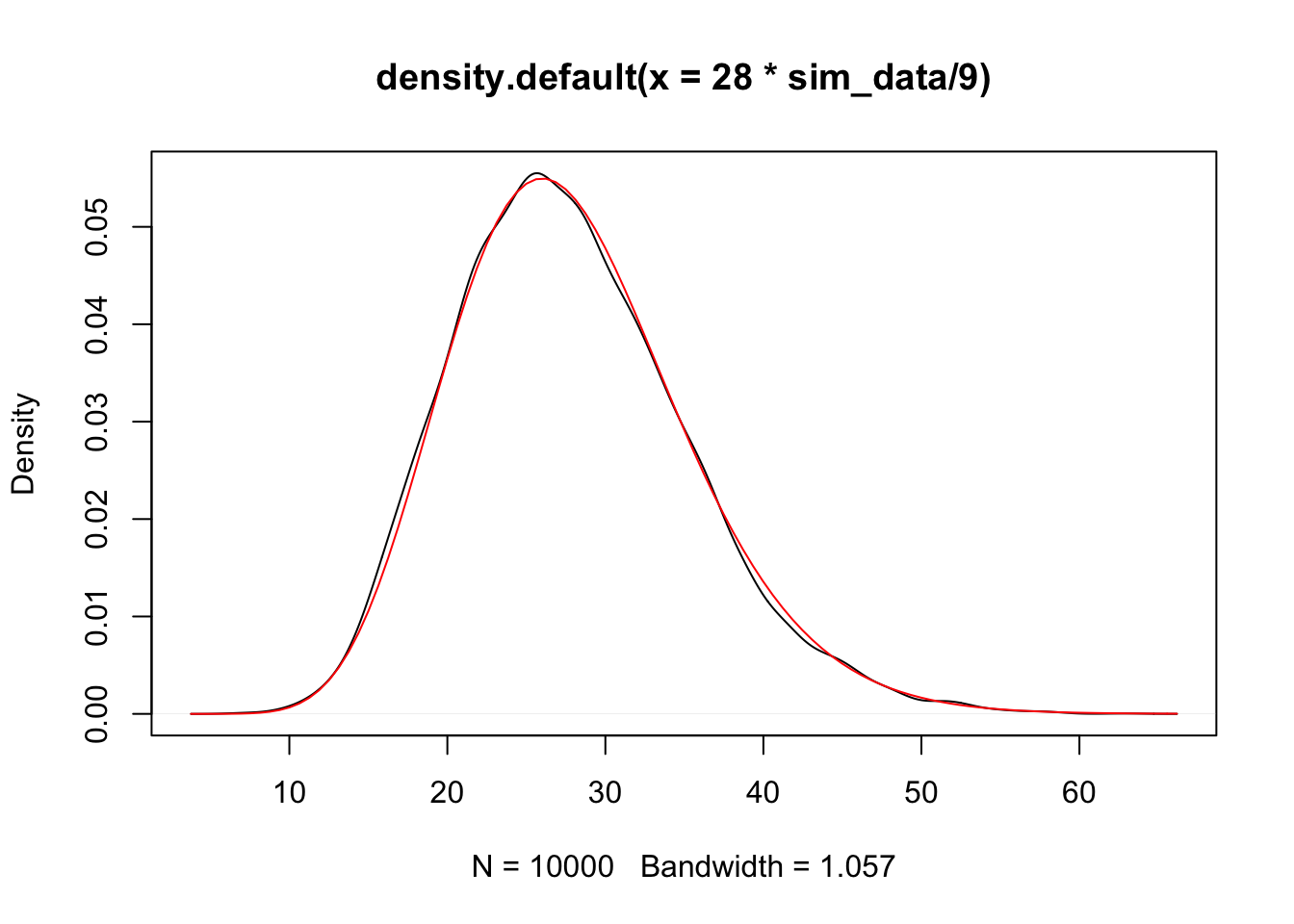

In this section, we see how to estimate the pdf of an rv and compare it to the pdf of a known distribution. We continue with the normal examples. Let’s verify that \(2X + 3Y\) is normal, when \(X \sim N(0, 1)\) and \(Y \sim N(1, 2)\). (\(Y\) has standard deviation 2).

sim_data <- replicate(10000, {

x <- rnorm(1, 0, 1)

y <- rnorm(1, 1, 2)

2 * x + 3 * y

})

plot(density(sim_data))

The plot(density()) command gives an estimated density plot of the rv that has data given in the argument of density. Let’s a

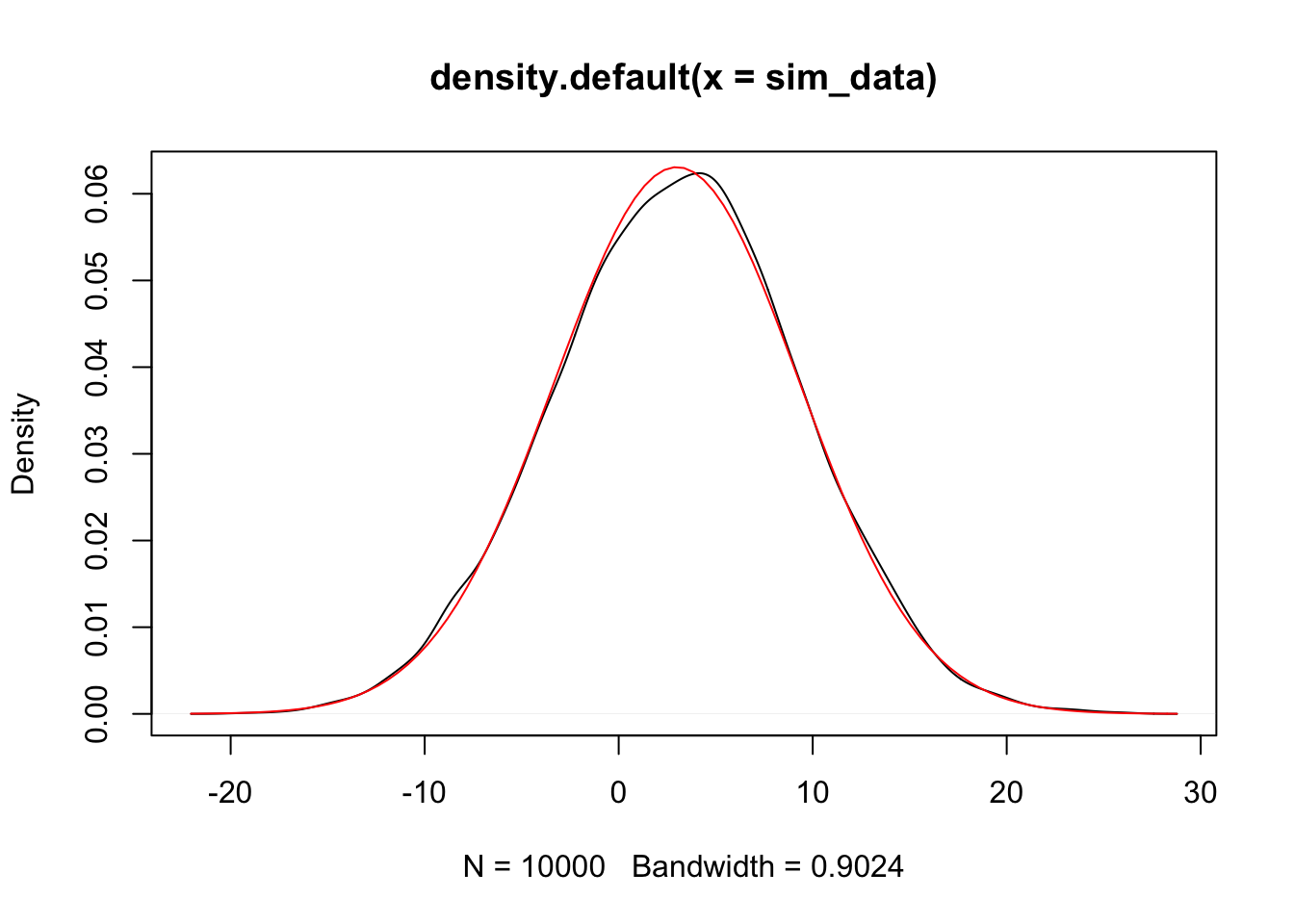

a pdf of a normal rv with the correct mean and standard deviation to the above plot, and see whether they match. The correct mean is \(2 * 0 + 3 * 1\) and the sd is \(\sqrt{4 * 1 + 9 * 4}\)

Alternatively, we could have used the simulated data and estimated the mean and sd.

plot(density(sim_data))

curve(dnorm(x,

mean(sim_data),

sd(sim_data)), a

= T, col = 2) #shows up in red

Since the estimated pdf of the simulated data matches that of the dnorm (more or less), we conclude that the distributions are the same. Note that if there is a discontinuity in the pdf, then the simulation will not match well at that point of discontinuity. Since we will mostly be dealing with normal rvs, we’ll cross that bridge when we get to it.

Exercise 2.1 Let \(X_1, \ldots, X_5\) be normal random variables with means \(1, 2, 3, 4, 5\) and variances \(1, 4, 9, 16, 25\).

What kind of rv is \(\overline{X}\)? Include the values of any parameters.

- Use simulation to plot the pdf of \(\overline{X}\) and confirm your answer to part 1.

One last concept that we will run across a lot is independence. Two random variables are independent if knowledge of the outcome of one gives no probabilistic information about the outcome of the other one. Formally, \(P(a \le X \le B|c \le Y \le d) = P(a \le X \le b)\) for all values of \(a, b, c\) and \(d\). It can be tricky to check this, and it is often something that we will assume rather than prove. However, one fact that we will use is that if \(X\) and \(Y\) are independent, then \(X + a\) and \(Y + b\) are also independent.

2.2 Linear Regression Overview

We present the basic idea of regression. Suppose that we have a collection of data that is naturally grouped into ordered pairs, \((x_1, y_1), \ldots, (x_n, y_n)\). For example, we could be measuring the height and weight of adult women, or the heights of fathers and their adult sons. In both instances, these data would naturally be grouped together into ordered pairs, and we would likely be interested in the relationship between the two variables. In particular, we would not want to assume that the variables are independent.

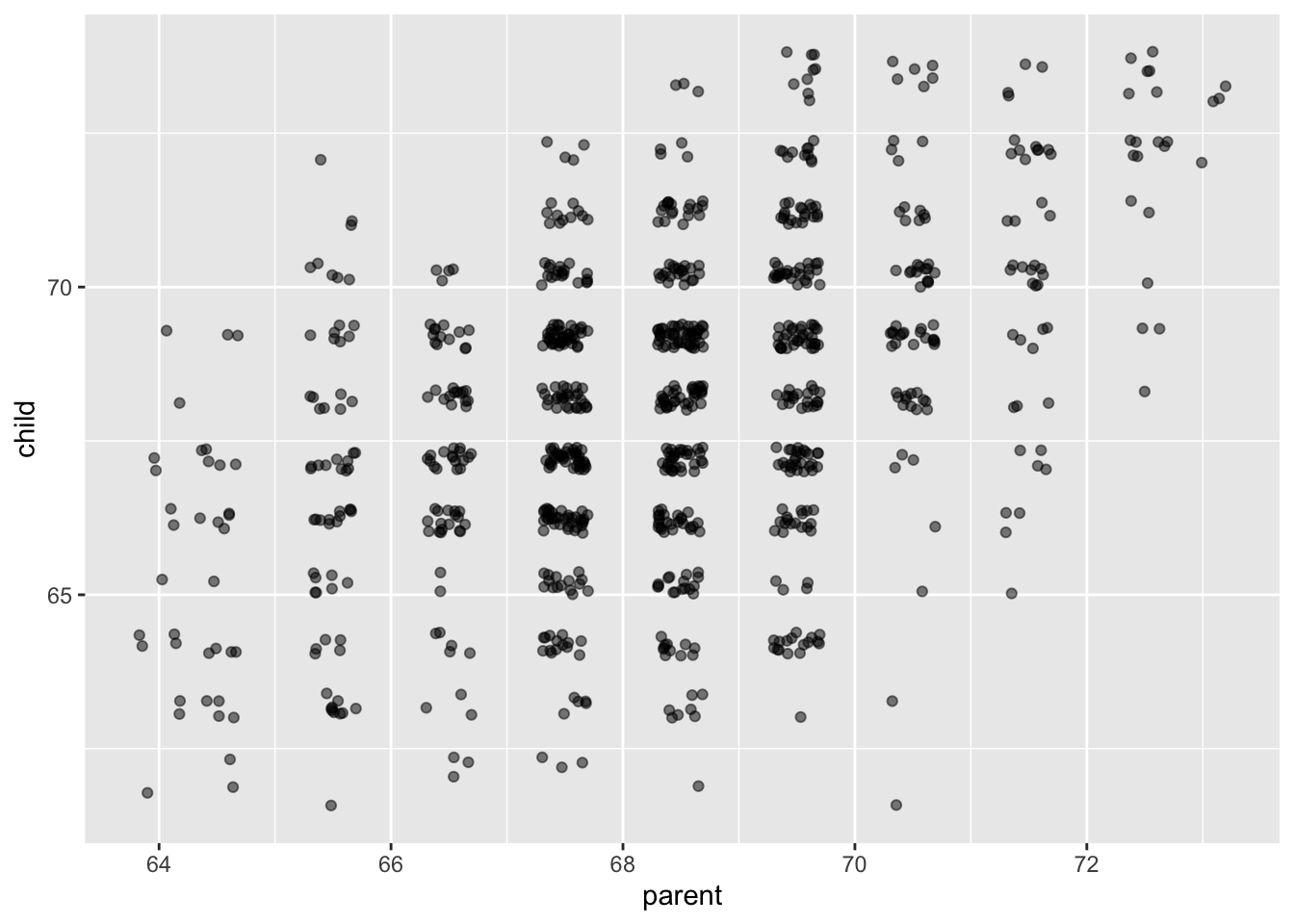

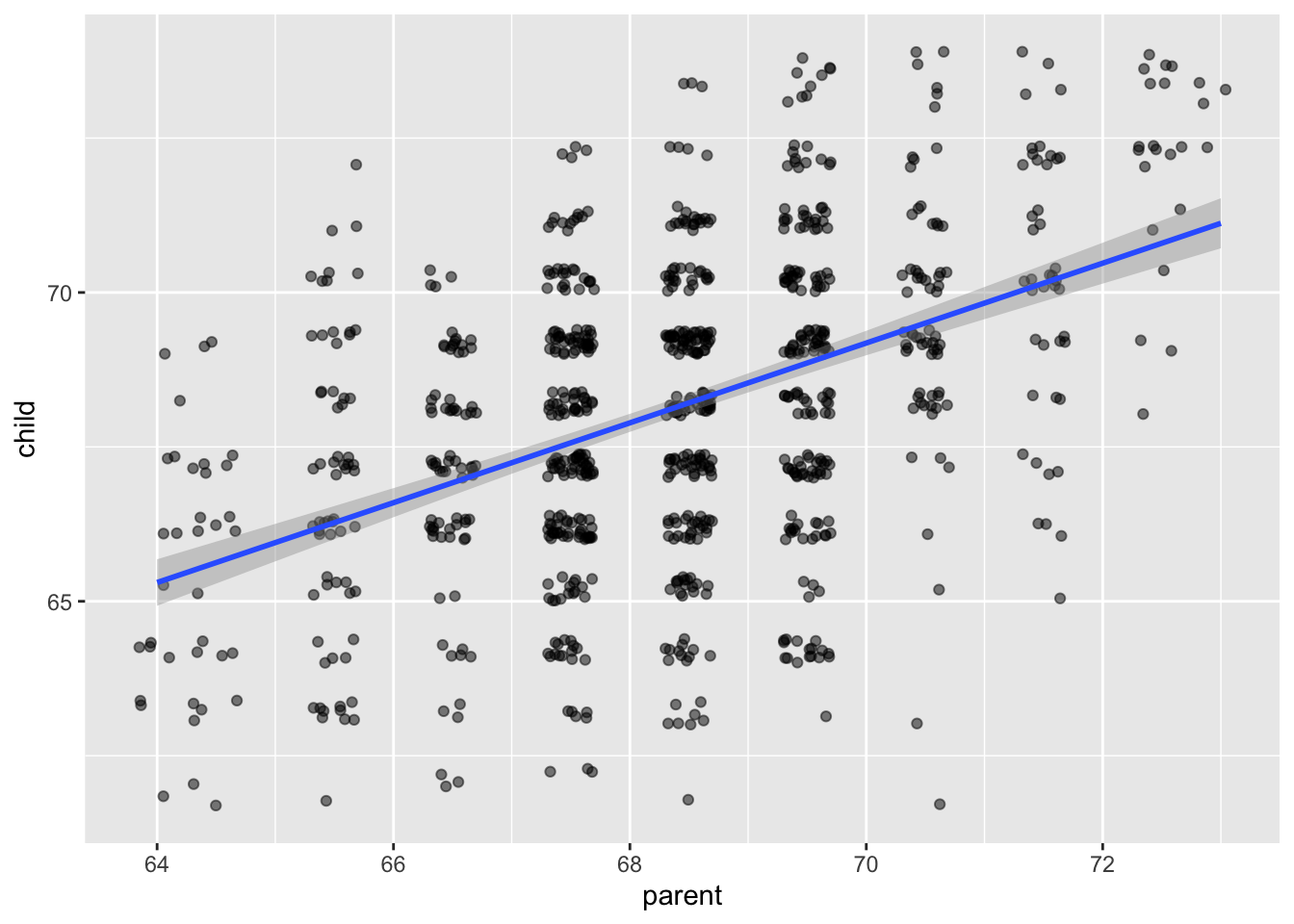

In the R package HistData, there is a data set that is the heights of parents and their adult children. Let’s take a look.

galton <- HistData::Galton

library(tidyverse)

ggplot(galton, aes(parent, child)) +

geom_jitter(alpha = .5)

It appears that there is a positive correlation between the height of a parent and the height of their adult child. (The parent value is the average of the father and mother of the child, and the child value has been adjusted for sex of the child. So, this may not be the best example of rigourous data collection!)

The model that we are using for this data is \[ y_i = \beta_0 + \beta_1 x_i + \epsilon_i \] where the \(\epsilon_i\) are independent normal random variables with mean 0 and unknown variance \(\sigma^2\). The \(\beta_0\) and \(\beta_1\) are unknown constants. The only randomness in this model comes from the \(\epsilon_i\), which we think of as the error of the model or the residuals of the model.

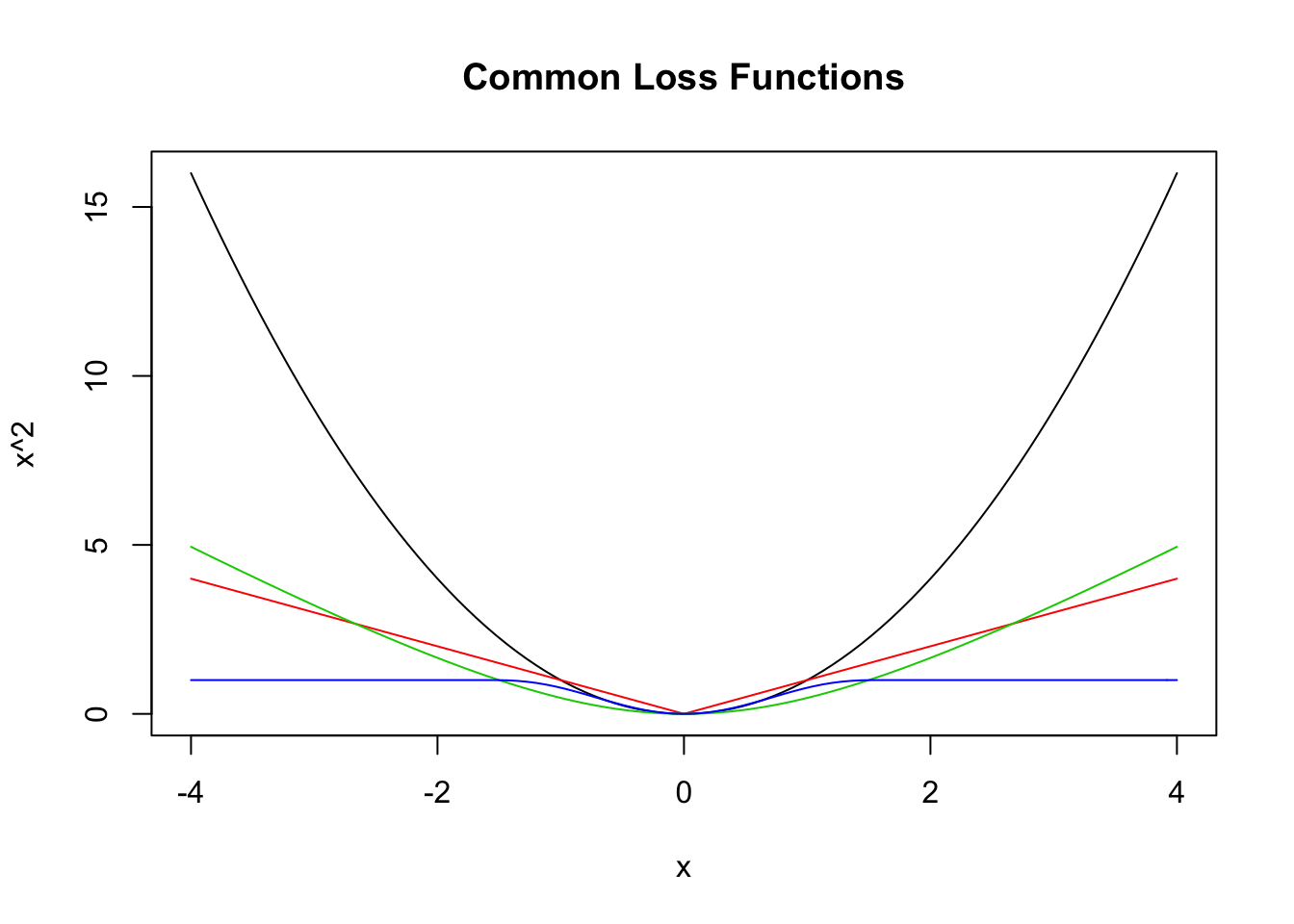

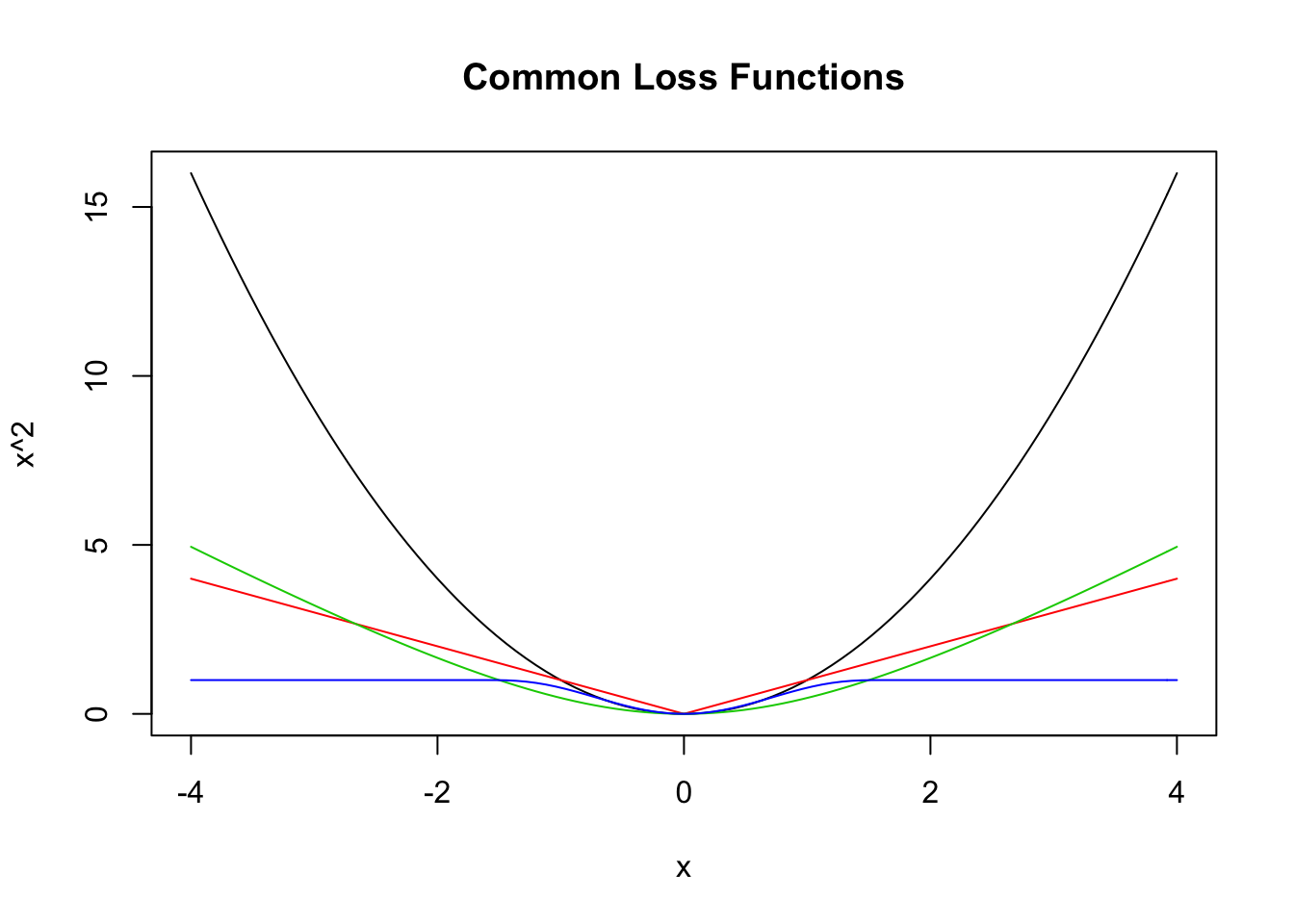

In order to estimate the values of the coefficients \(\beta_0\) and \(\beta_1\), we want to choose the values that minimize the total error associated with the line \(y = \beta_0 + \beta_1 x\). There are lots of ways to do this! Let’s begin by looking at the error at a single point, \(y_i - (\beta_0 + \beta_1 x_i)\). This is the observed value \(y_i\) minus the \(predicted\) value \(\beta_0 + \beta_1 x_i\). If we are trying to minimize the total error, we will want to take the absolute value or something of the error at each point and a them up. Here are a few ways we could do this.

\[\begin{align} SSE(\beta_0, \beta_1) &= \sum_{i = 1}^n \bigl(y_i - (\beta_0 + \beta_1 x_i)\bigr)^2\\ L_1(\beta_0, \beta_1) &= \sum_{i = 1}^n \bigl|y_i - (\beta_0 + \beta_1 x_i)\bigr|\\ E_g(\beta_0, \beta_1) &= \sum_{i = 1}^n g(y_i - \beta_0 + \beta_1 x_i) \end{align}\]

where \(g\) is a loss function such that \(g(x) = g(-x)\) and \(g(x) \le g(y)\) whenever \(0 \le x \le y\). Here are a few more loss functions \(g\) that are commonly used.

curve(x^2, from = -4, to = 4, col = 1,

main = "Common Loss Functions") #black

curve(abs(x), add = T, col = 2) #red

delta <- 2

curve(delta^2 *(sqrt(1 + (x/delta)^2) - 1),

add= T,

col = 3) #green

curve(robustbase::Mchi(x, cc = 1.6, psi = "bisquare"),

add= T,

col = 4) #bue

The idea is that we want to minimize the sum of the loss function evaluated at the differences between the observed and the predicted values. We will see in later sections how to do that via math, but we also have R, which is good at doing things like this.

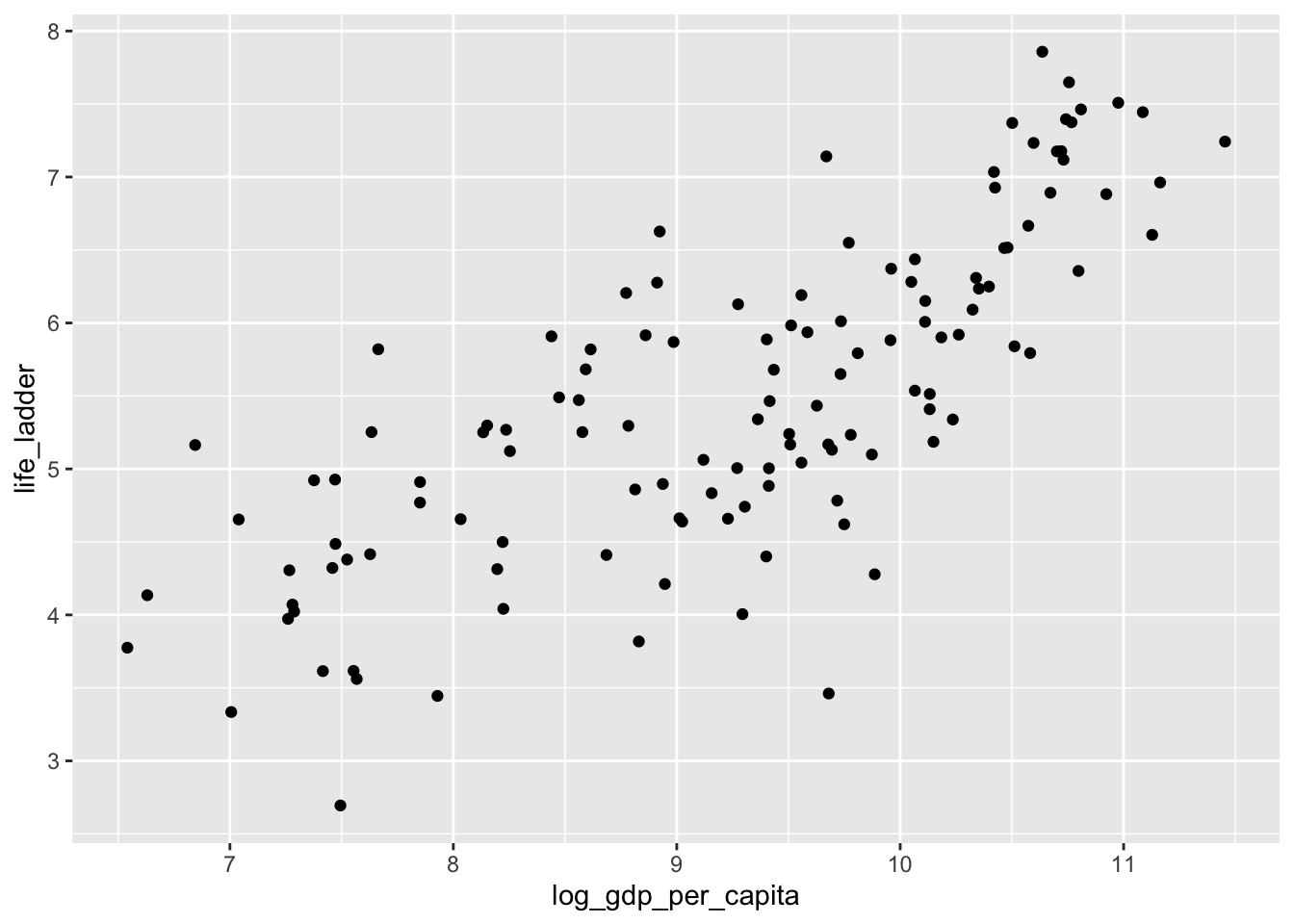

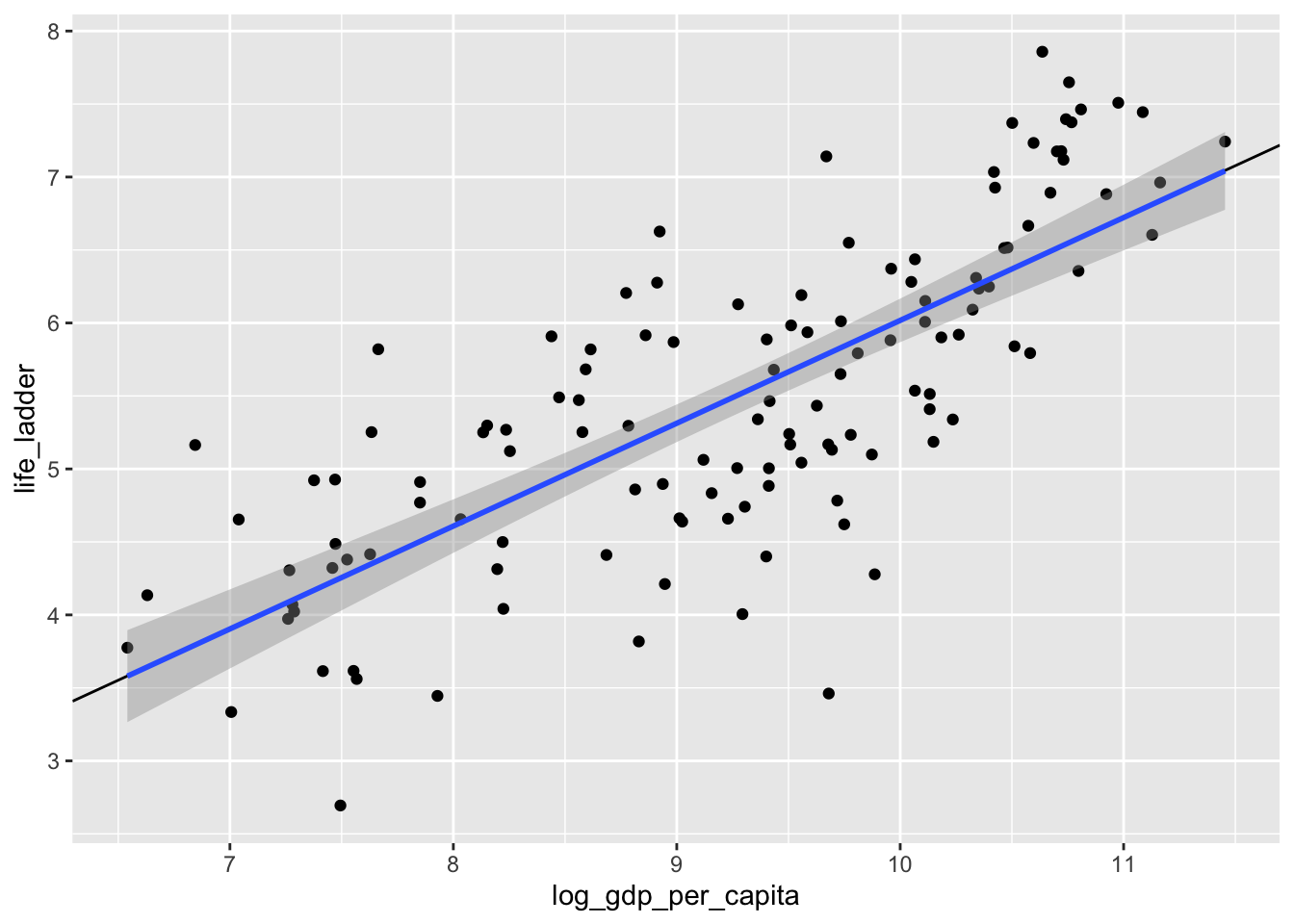

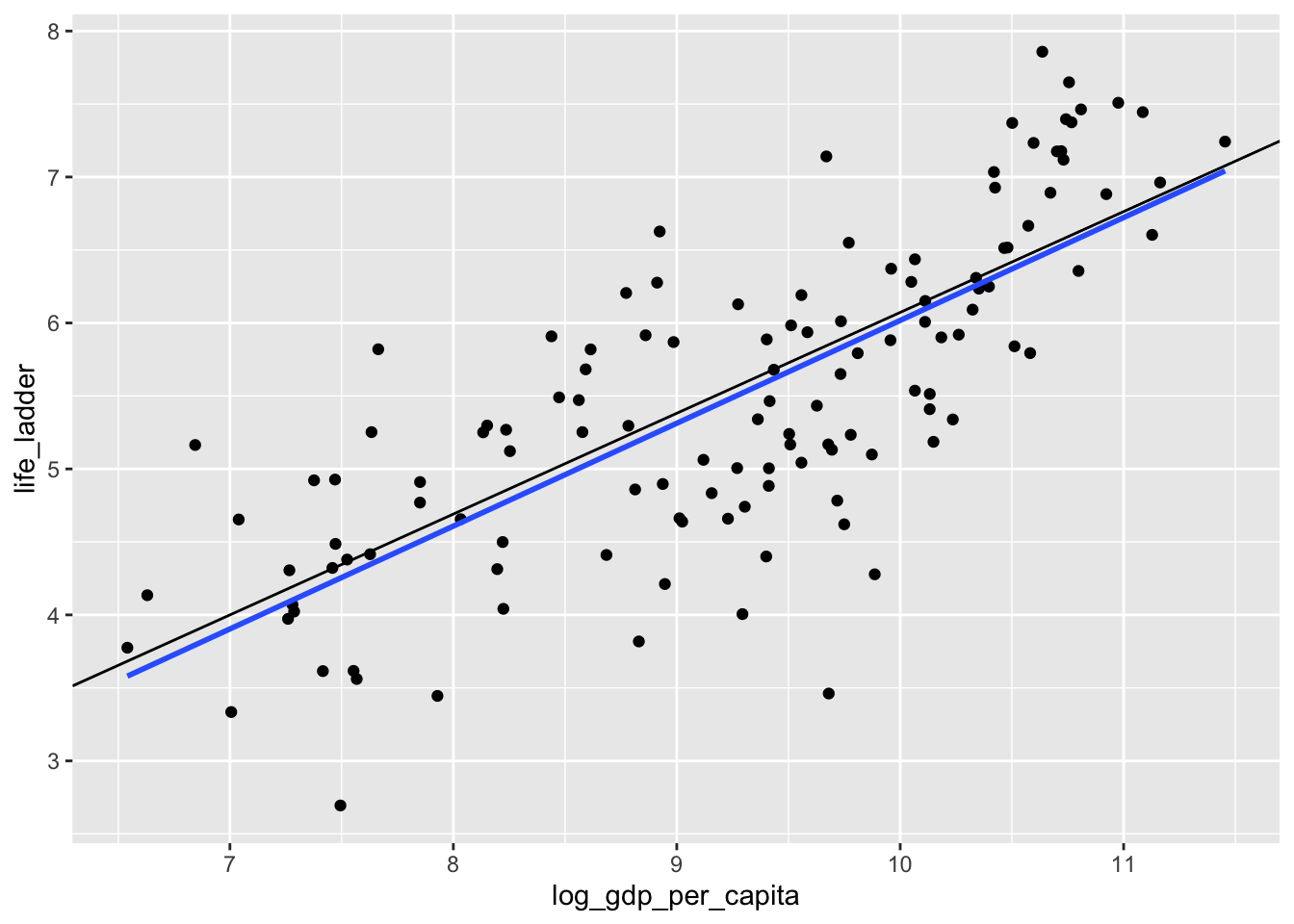

Let’s look at a different data set. This is the world happiness data set. People were surveyed in various countries around the world and asked to imagine the best life possible for them as a 10, and the worst life possible as a 0. Then they were asked to assign a number to their current life between 0 and 10. The results of the survey are summarized here.

dd <- readxl::read_xls("../4870/data/world_happiness_data.xls") #This won't work for you!

dd <- filter(dd, Year == 2018) %>%

janitor::clean_names()

dd <- select(dd, country_name, life_ladder, log_gdp_per_capita)

ggplot(dd, aes(x = log_gdp_per_capita, y = life_ladder)) +

geom_point()## Warning: Removed 9 rows containing missing values (geom_point).

Let’s get rid of the data with missing values, and store the resulting variable in happy for future use, since dd will get overwritten later.

Now, let’s find values of \(\beta_0\) and \(\beta_1\) that minimize the SSE. (We’ll do the other loss functions below.)

The minimization function that we are going to use requires the sse function to be in a format where it accepts a single vector of values.

Now, we can call optim to optimize the SSE (which minimizes it).

## $par

## [1] -1.0302082 0.7047482

##

## $value

## [1] 64.32955

##

## $counts

## function gradient

## 79 NA

##

## $convergence

## [1] 0

##

## $message

## NULLWe see that the intercept is about -1.03 and the slope is about 0.705. Let’s plot that on the scatterplot.

ggplot(dd, aes(x = log_gdp_per_capita, y = life_ladder)) +

geom_point() +

geom_abline(slope = 0.705, intercept = -1.03) +

geom_smooth(method = "lm")

Yep. That’s the line that minimizes the sum of squares error, all right!

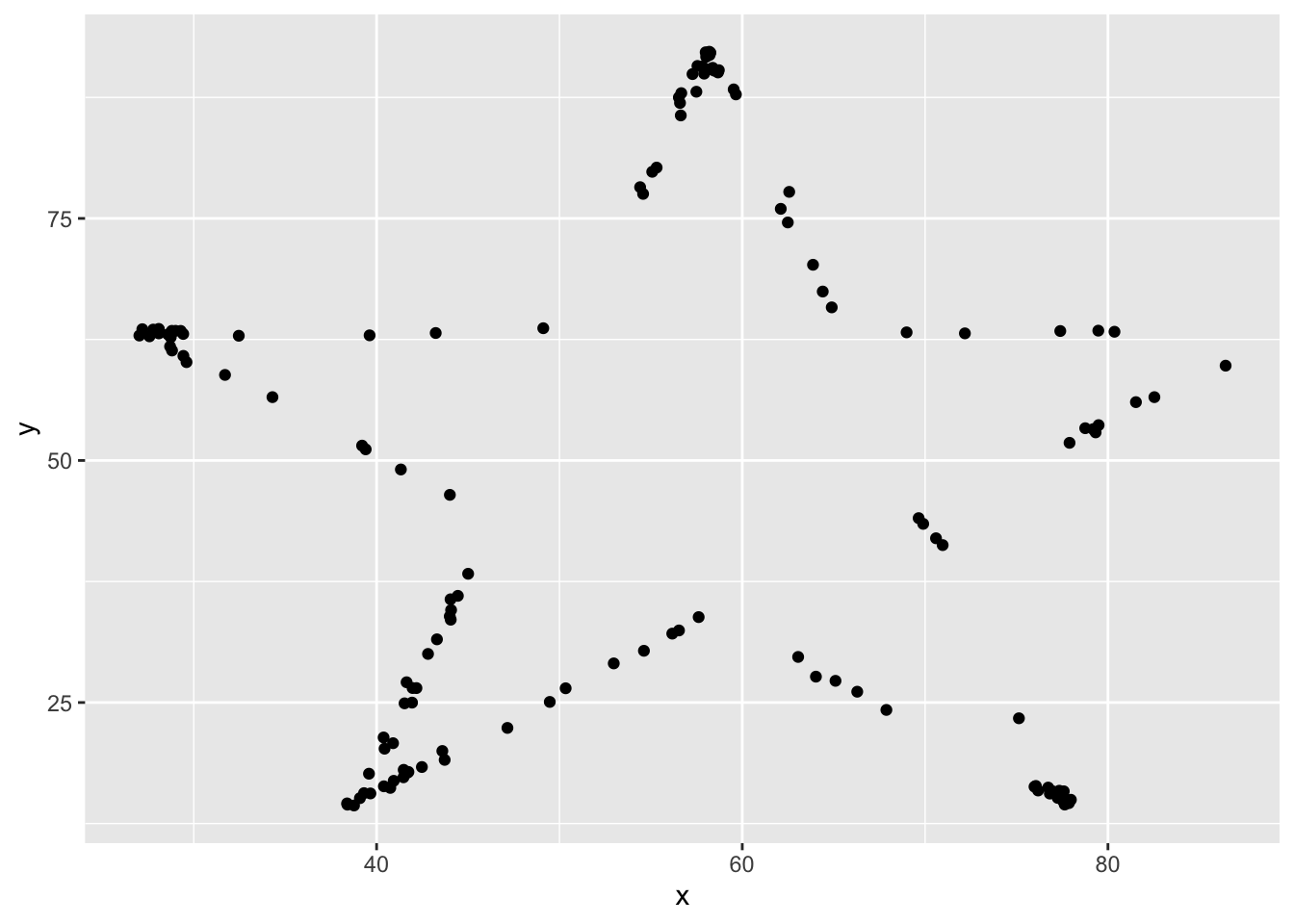

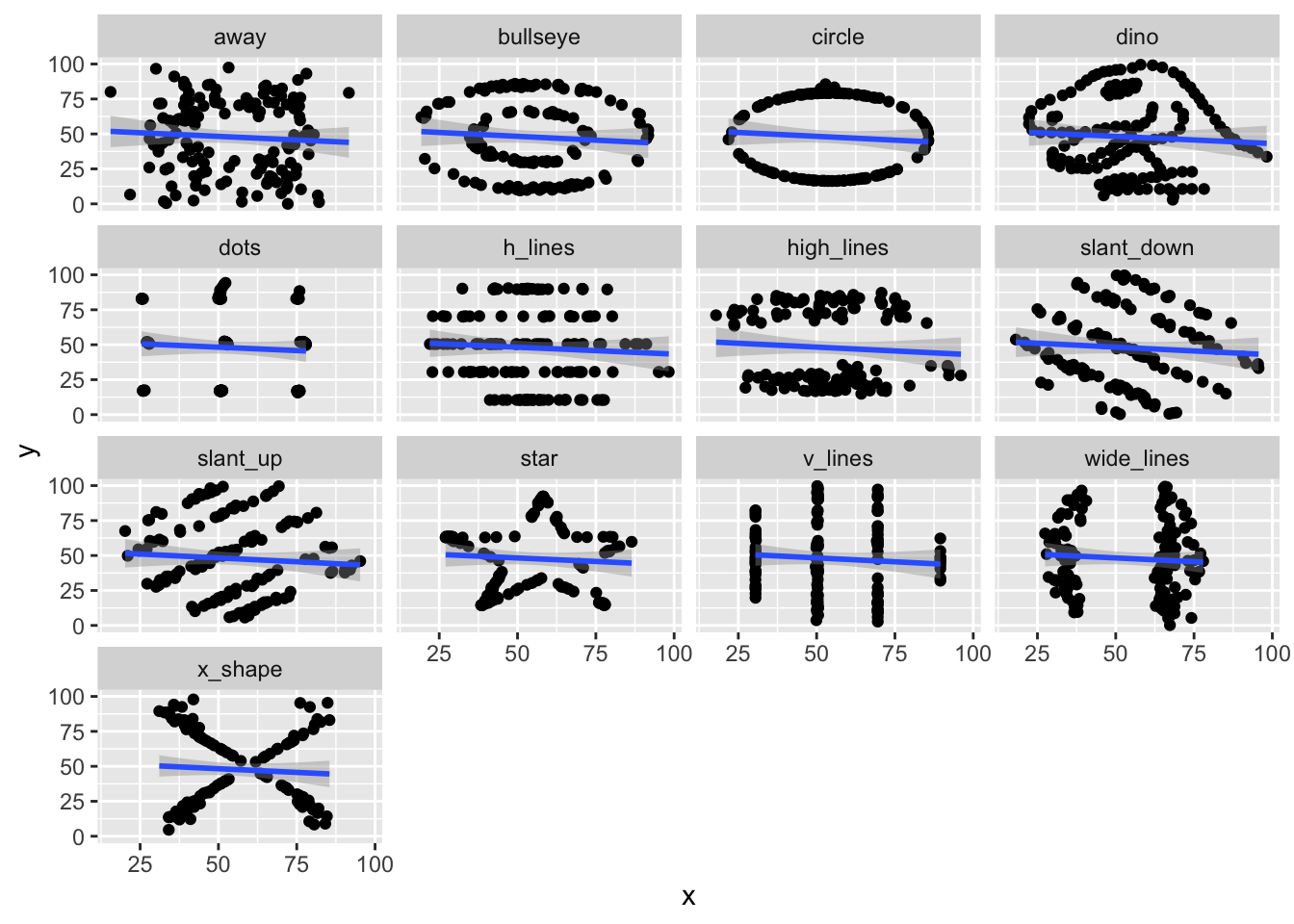

Let’s look at one more set of data, the datasauRus. You will need to install the datasauRus package if you have not already done so via install.packages("datasauRus"). The datasauRus package contains several interesting simulated data sets. The one we are interested in for now is the datasaurus_dozen, which we store into dd.

We see that the datasaurus_dozen is a list of 12 data sets (I think), and that it has \((x, y)\) coordinates, together with a dataset variable. Let’s see what datasets are available to us.

## [1] "dino" "away" "h_lines" "v_lines" "x_shape"

## [6] "star" "high_lines" "dots" "circle" "bullseye"

## [11] "slant_up" "slant_down" "wide_lines"I’ll do this example with star, but, you should follow along with a different one.

Yep, it looks like a star! This certainly is not of the form \(y = \beta_0 + \beta_1 x + \epsilon\) (Why?), but we can still find the line that is the best fit of this data. Not saying it will be a good fit, but it is still the one that minimizes SSE.

sse <- function(b0, b1) {

sum((star$y - (b0 + b1 * star$x))^2)

}

sse_one_argument <- function(b){

sse(b[1], b[2])

}

optim(par = c(50, 0), fn = sse_one_argument)## $par

## [1] 53.331713 -0.101214

##

## $value

## [1] 101853.4

##

## $counts

## function gradient

## 59 NA

##

## $convergence

## [1] 0

##

## $message

## NULLWe see that the line of best fit is \(y = 53.33 - .10124 x\). Now, let’s take a look at the line of best fit for all of the data sets. We’ll use ggplot and facet_wrap.

It turns out that all 12 of these data sets have very similar lines of best fit!

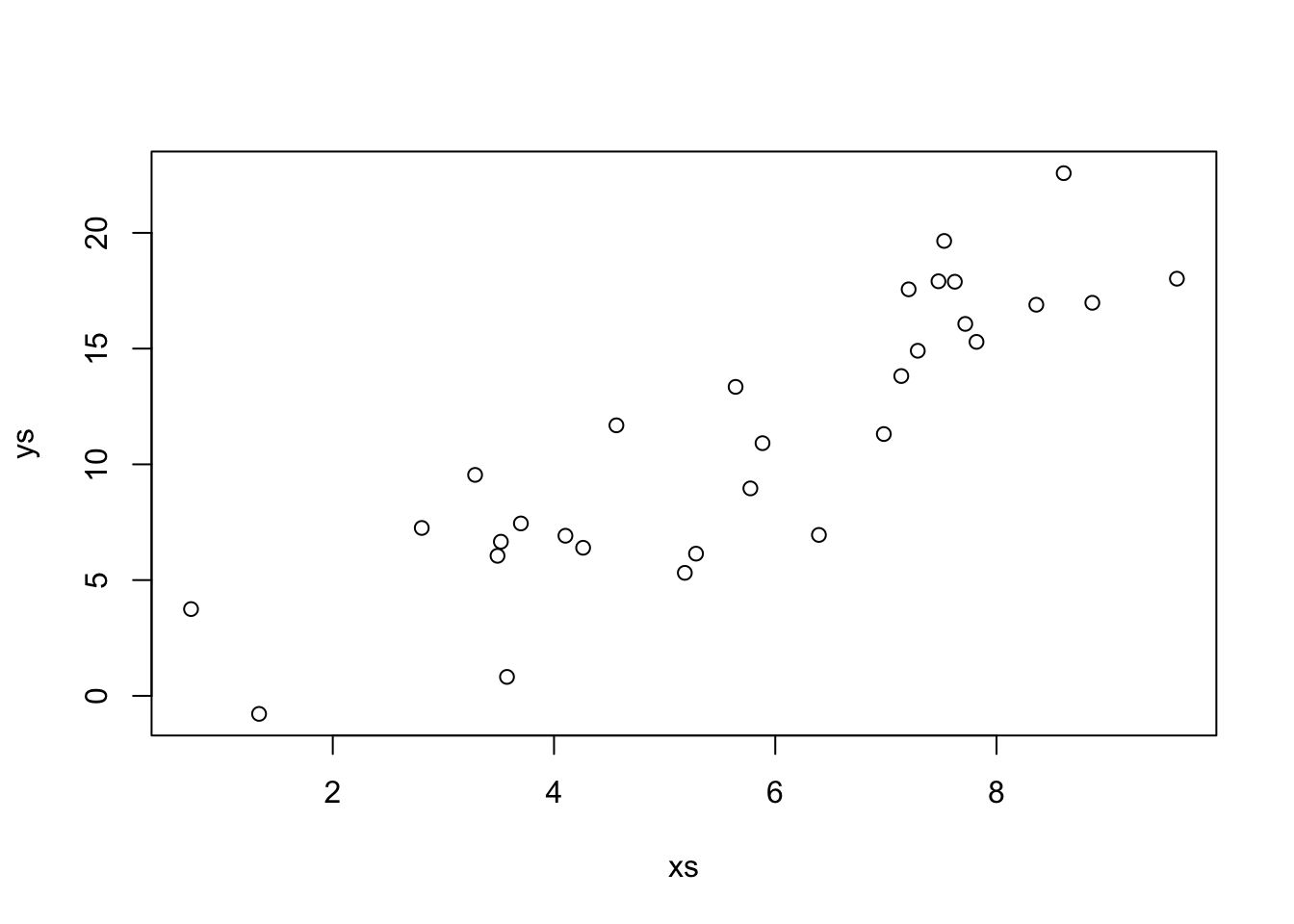

Exercise 2.2 Consider the data set ISwR::bp.obese. If you have never installed the ISwR package, you will need to run install.packages("ISwR") before accessing this data set.

Find the line of best fit for modeling blood pressure versus obesity by minimizing the SSE.

Does it appear that the model \(y = \beta_0 + \beta_1 x + epsilon\), where \(y\) is bp, \(x\) is obese, and \(\epsilon\) is normal with mean 0 and standard deviation \(\sigma\) is correct for this data?

2.3 Linear Regression with no intercept

We will present the theory of linear regression with no intercept. You will be asked as an exercise to repeat the arguments for linear regression with fixed slope of 1. The theory in these cases is easier than in the general case, but the ideas are similar.

I hope that you will be able to better understand the general case after having worked through these two special cases. Our model is \[ y_i = \beta_1 x_i + \epsilon_i \] where \(\epsilon_i\) are assumed to be normal with mean 0 and unknown variance \(\sigma^2\). We still wish to minimize the sum-sqaured error of the predicted values (\(\beta_1 x_i\)) relative to the observed values (\(y_i\)). That is, we want to minimize \[ SSE(\beta_1) = \sum_{i = 1}^n \bigl(y_i - \beta_1 x_i\bigr)^2 \] In this case, there is only one unknown constant in the equation for SSE. (But, of course, we still don’t know \(\sigma\).) Let’s math it.

\[ \begin{aligned} \frac {d}{d\beta_1} SSE(\beta_1) &= \sum_{i = 1}^n 2(\bigl(y_i - \beta_1 x_i\bigr) x_i)\\ &=2\sum_{i = 1}^n y_i x_i - 2\beta_1 \sum_{i = 1}^n x_i^2. \end{aligned} \]

Setting this equal to zero and solving for \(\beta_1\) gives \[ \beta_1 = \frac{\sum_{i = 1}^n x_i y_i}{\sum_{i = 1}^n x_i^2} \] This is our estimate for \(\beta_1\), so we add a ^ to it to make this indication. In general, hats on tops of constants will indicate our estimates for the constants based on data. \[ \hat \beta_1 = \frac{\sum_{i = 1}^n x_i y_i}{\sum_{i = 1}^n x_i^2} \]

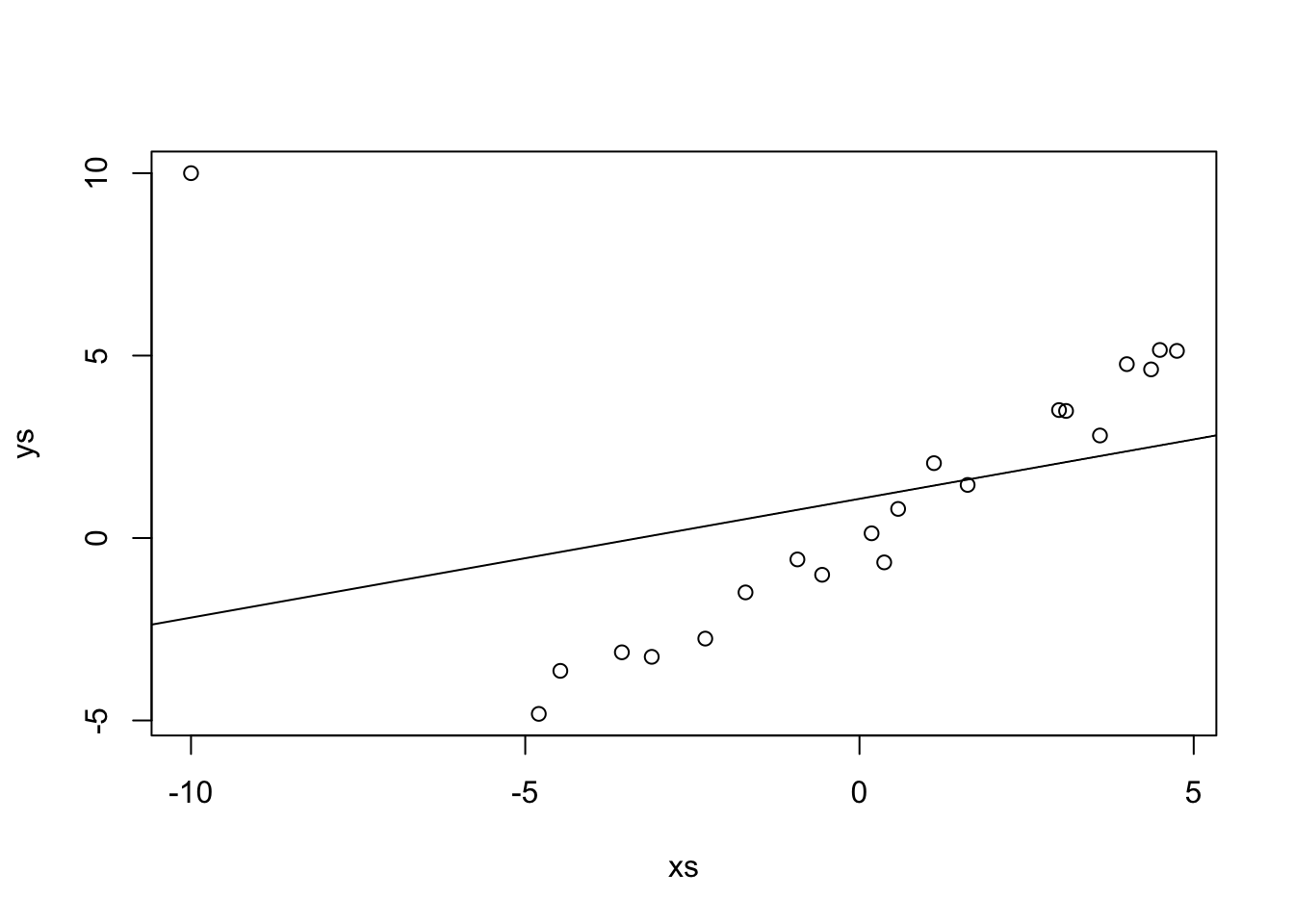

Let’s look at some simulated data to see how this performs.

Our estimate for the slope is

That looks pretty good! Let’s look at the formula for \(\hat \beta_1\) in some more detail. In particular, let’s assume that our model is correct, and that \(y_i = \beta_1 x_i + \epsilon_i\), where \(\epsilon_i\) are independent normal rvs with mean 0 and variance \(\sigma^2\). Under this model, the \(x_i\) are constants; there is nothing random about them contained in the model. However, the \(y_i\) are random variables! The \(y_i\) are the sum of a constant (\(\beta_1 x_i\)) and a normal random variable. By Theorem 2.1, that means that \(y_i\) is also normal. The mean of \(y_i\) is \(\beta_1 x_i\) and the variance of \(y_i\) is \(\sigma^2\).

Question Are the \(y_i\) independent or dependent? There are spoilers below, so think about this before you read further.

So, up to know, we have that \(\hat \beta_1 = \frac{\sum x_i y_i}{\sum x_i^2} = \frac{1}{\sum x_i^2}\sum x_i y_i\). The pieces are the constants \(x_i\) and the normal random variables \(y_i\). Let’s compute the expected value of \(\hat \beta_1\).

\[ \begin{aligned} E[\hat \beta_1] &= E\bigl[\frac {1}{\sum x_i^2}\sum x_i y_i\bigr]\\ &= \frac {1}{\sum x_i^2} \sum_{i = 1}^n x_i E[y_i]\\ &= \frac {1}{\sum x_i^2} \sum_{i = 1}^n x_i \beta_1 x_i\\ &= \beta_1 \frac{\sum x_i^2}{\sum x_i^2}\\ &= \beta_1 \end{aligned} \]

That’s not an easy computation, but it says something really important about regression with no intercept. It says that the expected value of our estimate for the slope, is the slope itself! We expect, on average, to be exactly right in our estimate of the slope. These types of estimators are called unbiased estimators, and we have shown that \(\hat \beta_1\) is an unbiased estimator of \(\beta_1\). That is definitely a desirable property of an estimator, though it is not necessarily a deal-breaker if an estimator is biased. I’m looking at you, sample standard deviation.

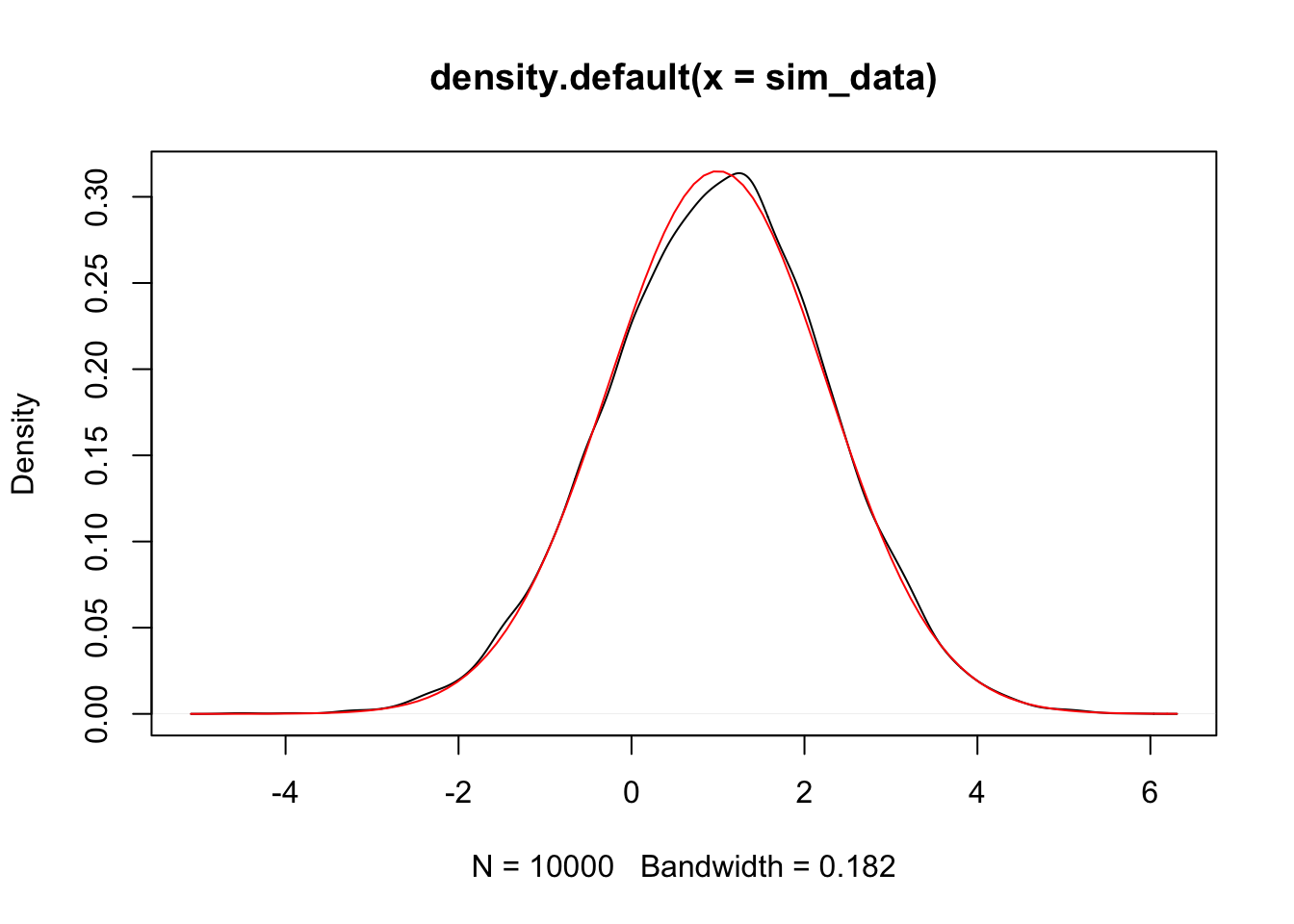

Let’s check out what this would mean via simulations. We assume that the data comes from \(y = 2 x + \epsilon\), where \(\epsilon \sim N(0,\sigma = 3)\). Let’s imagine that we have fixed values of xs, but this is not really necessary.

Then we will create a data set and estimate the slope.

## [1] 1.85963Next, we put that inside of replicate to get a large sample of possible estimates of slopes.

And we compute the mean. We should get something really close to 2, which is the true value of the slope.

## [1] 2.000284To be safe, we should repeat that a few times to see if the estimated expected value of \(\hat \beta_1\) is on both sides of 2, and doesn’t seem to be biased. More generally, we know that \(\hat \beta_1\) is a normal random variable with mean 2. What is its variance? Well, since the \(y_i\) are independent, we can compute the variance as follows.

\[ \begin{aligned} V(\hat \beta_1) &= V(\frac {1}{\sum x_i^2}\sum x_i y_i)\\ &= \frac{1}{(\sum x_i^2)^2} \sum x_i^2 V(y_i)\\ &= \frac{1}{(\sum x_i^2)^2} \sum x_i^2 \sigma^2\\ &= \frac{\sigma^2}{\sum x_i^2} \end{aligned} \]

Again, let’s check that is true via… simulations!

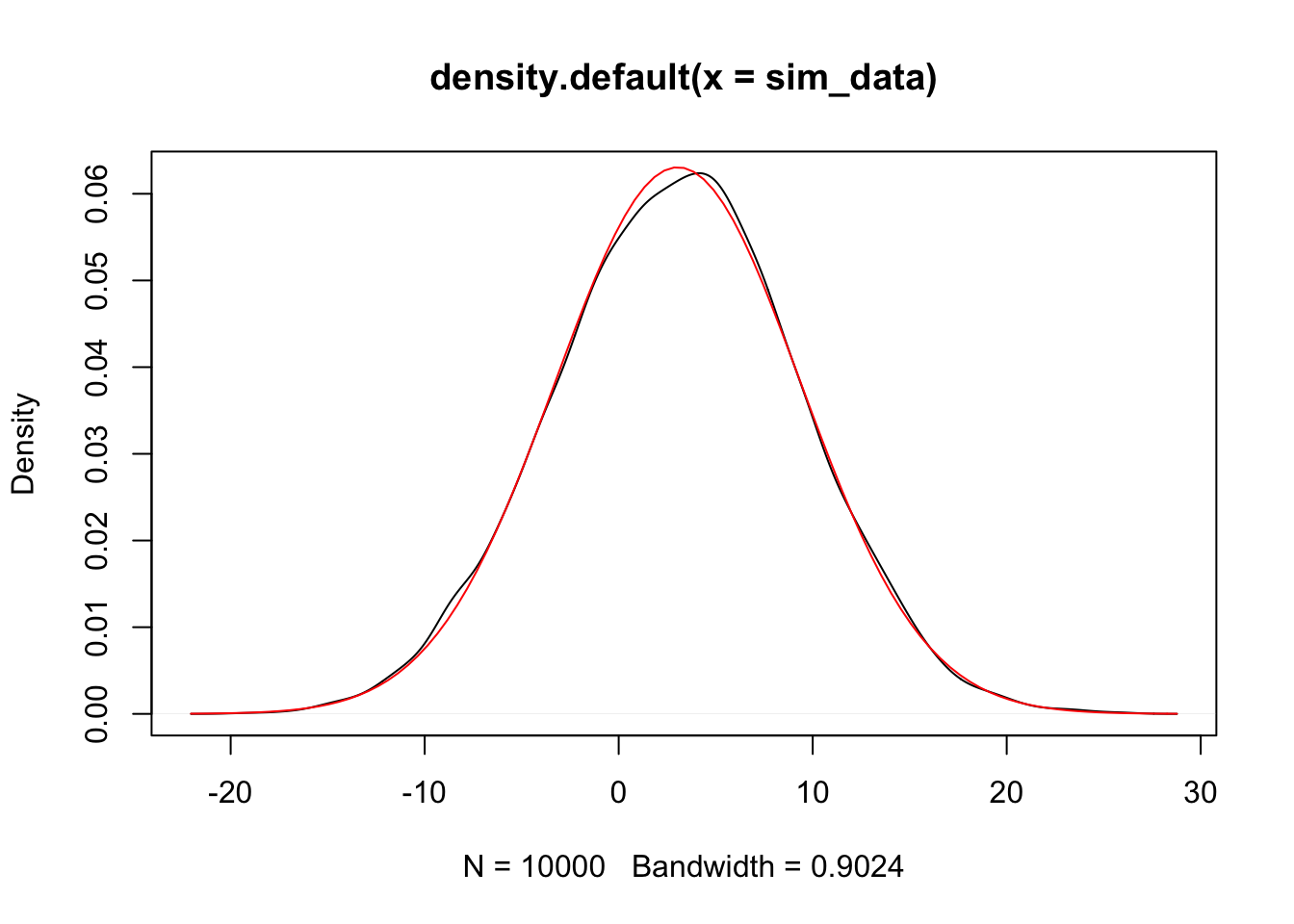

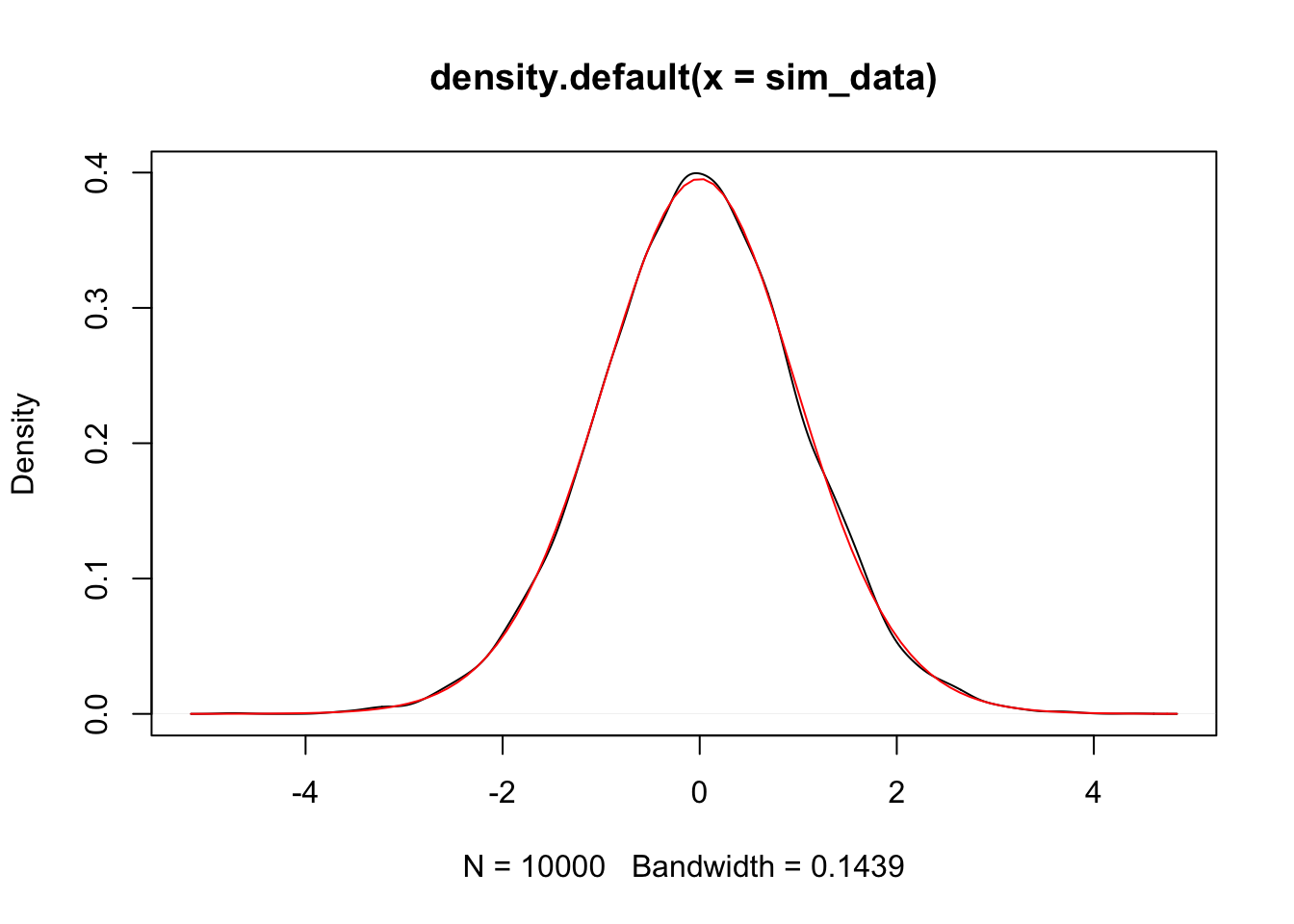

## [1] 0.008707521## [1] 0.008847458Looks pretty good! Again, we would need to repeat a few times to be sure. Finally, let’s estimate the density function of \(\hat \beta_1\) and compare it to that of a normal with the above mean and standard deviation.

That is compelling to me. We have seen that \(\hat \beta_1\) is normal with mean \(\beta_1\) and standard deviation \(\frac{\sigma}{\sqrt{\sum x_i^2}}\)

Exercise 2.3 Suppose you wish to model data \((x_1, y_1), \ldots, (x_n, y_n)\) by \[ y_i = \beta_0 + x_i + \epsilon_i \] \(\epsilon_i\) are iid normal with mean 0 and standard deviation \(\sigma\).

Find the \(\beta_0\) that minimizes the SSE, \(\sum(y_i - (\beta_0 + x_i))^2\) in terms of \(x_i\) and \(y_i\). Call this estimator \(\hat \beta_0\).

What kind of random variable is \(\hat \beta_0\)? Be sure to include both its mean and standard deviation or variance (in terms of the \(x_i\)).

Verify your answer via simulation when the true relationship is \(y = 2 + x + \epsilon\), where \(\epsilon\) is normal with mean 0 and standard deviation 1.

2.4 The full model

In this section, we discuss the model

\[ y_i = \beta_0 + \beta_1 x_i + \epsilon_i \]

We minimize

\[ SSE(\beta_0, \beta_1) = \sum \bigl(y_i - (\beta_0 + \beta_1 x_i)\bigr)^2 \] over all choices of \(\beta_0\) and \(\beta_1\) by taking the partials with respect to \(\beta_0\) and \(\beta_1\), setting equal to zero, and solving for \(\beta_0\) and \(\beta_1\). We omit the details. But, here are the solutions that you obtain.

\[\hat \beta_0 = \overline{y} - \hat \beta_1 \overline{x}\]

\[\hat \beta_1 = \frac{\sum x_i y_i - \frac 1n \sum x_i \sum y_i}{\sum x_i^2 - \frac 1n \sum x_i \sum x_i}\]

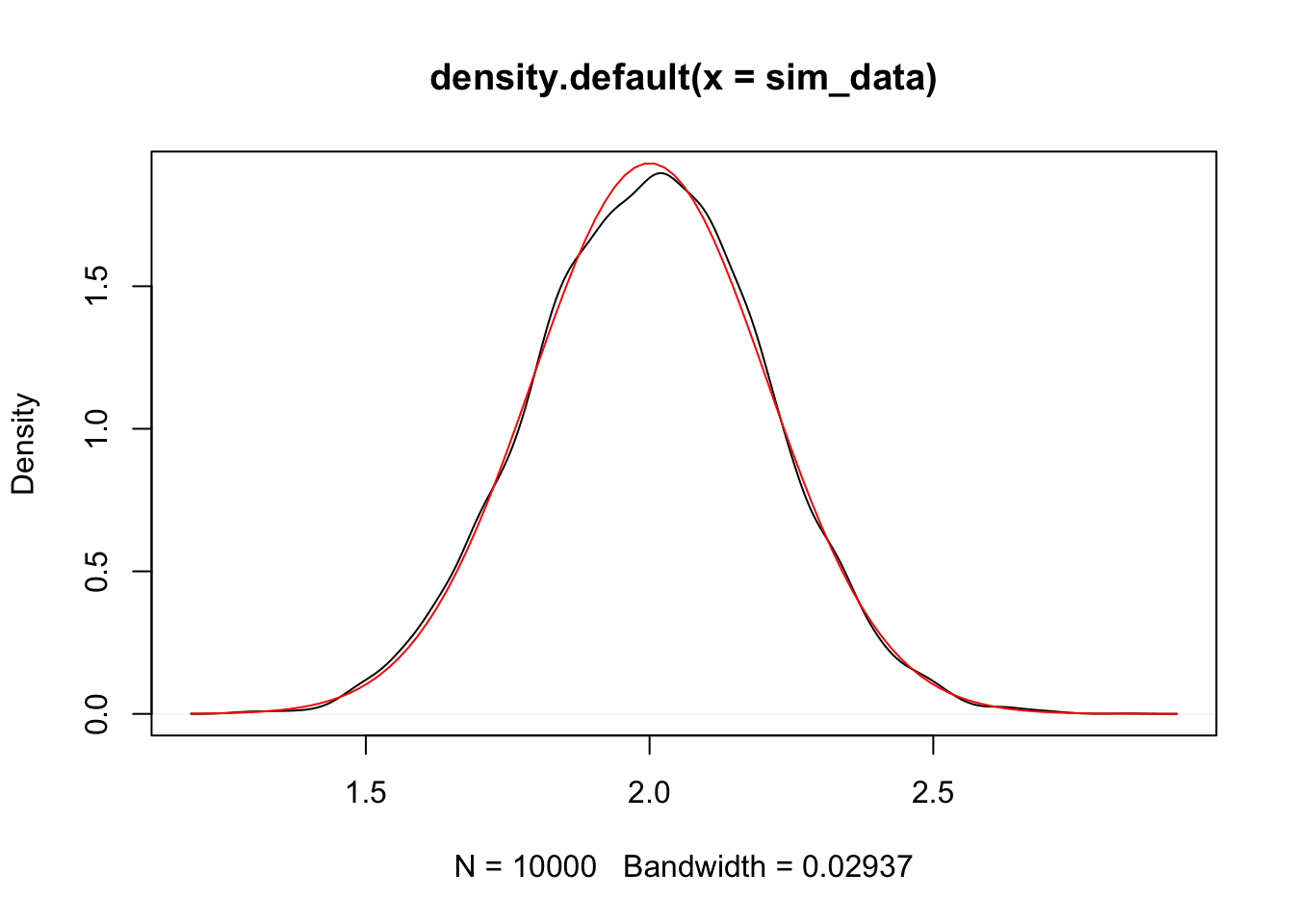

As before, we can see that \(\hat \beta_0\) and \(\hat \beta_1\) are linear combinations of the \(y_i\), so they are normal random variables. We won’t go through the algebraic details, but it is true that \(\hat \beta_0\) is normal with mean \(\beta_0\) and variance \(\sigma^2 \frac{\sum x_i^2}{n\sum x_i^2 - \sum x_i \sum x_i}\), while \(\hat \beta_1\) is normal with mean \(\beta_1\) and variance \(\frac{n\sigma^2}{n \sum x_i^2 - \sum x_i \sum x_i}\). Let’s check this with some simulations!

xs <- runif(30, 0, 10)

sx <- sum(xs)

sx2 <- sum(xs^2)

ys <- 1 + 2 * xs + rnorm(30, 0, 3)

lm(ys ~ xs)$coefficients[1] #pulls out the intercept## (Intercept)

## 1.286636sim_data <- replicate(10000, {

ys <- 1 + 2 * xs + rnorm(30, 0, 3)

lm(ys ~ xs)$coefficients[1]

})

mean(sim_data) #should be close to 1## [1] 1.002606## [1] 1.628629## [1] 1.604461Let’s also plot it to double check normality.

We do a similar simulation for \(\beta_1\) below.

xs <- runif(30, 0, 10)

sx <- sum(xs)

sx2 <- sum(xs^2)

ys <- 1 + 2 * xs + rnorm(30, 0, 3)

lm(ys ~ xs)$coefficients[2] #pulls out the intercept## xs

## 1.947199sim_data <- replicate(10000, {

ys <- 1 + 2 * xs + rnorm(30, 0, 3)

lm(ys ~ xs)$coefficients[2]

})

mean(sim_data) #should be close to 2## [1] 1.999415## [1] 0.04240855## [1] 0.04264637And again, we plot the density and compare to normal curve.

We can use this information to perform hypothesis tests and create confidence intervals!

2.4.1 Hypothesis Test Interlude

Recall how hypothesis tests work. We have a probability distribution that depends on a parameter \(\alpha\), say. There is some default, or conventional wisdom, idea about the value of \(\alpha\). We call this value \(\alpha_0\). We are testing whether \(\alpha = \alpha_0\) or whether \(\alpha \not= \alpha_0\). Formally, we vall \(H_0: \alpha = \alpha_0\) the null hypothesis and \(H_a: \alpha \not= \alpha_0\) the alternative hypothesis.

The format of the hypothesis test works as follows. We create a test statistic \(T\) that depends on the random sample we take and the parameter \(\alpha\). We need to be able to derive or simulate the probability density function of \(T\). When we do that, we then compute a \(p\)-value, which is the probability of obtaining a test statistic \(T\), which is as likely or more unlikely than the one that we did compute, assuming that \(H_0\) is true. If this \(p\)-value is small, say less than \(.05\), then we reject \(H_0\) in favor of \(H_a\). Otherwise, we fail to reject \(H_0\).

In regression, it is common to do hypothesis tests on \(\beta_1\), the slope. It is less common to do them on the intercept, because often the intercept is harder to interpret in the context of a problem. Let’s return to the happiness data, which is stored in happy. We computed a line of best fit of \(y = -1.03 + 0.705 x\). A natural question to ask is whether the slope is actually zero, or whether it is not zero. Formally, we have the hypothesis test \(H_0: \beta_1 = 0\) versus \(H_a: \beta_1 \not= 0\).

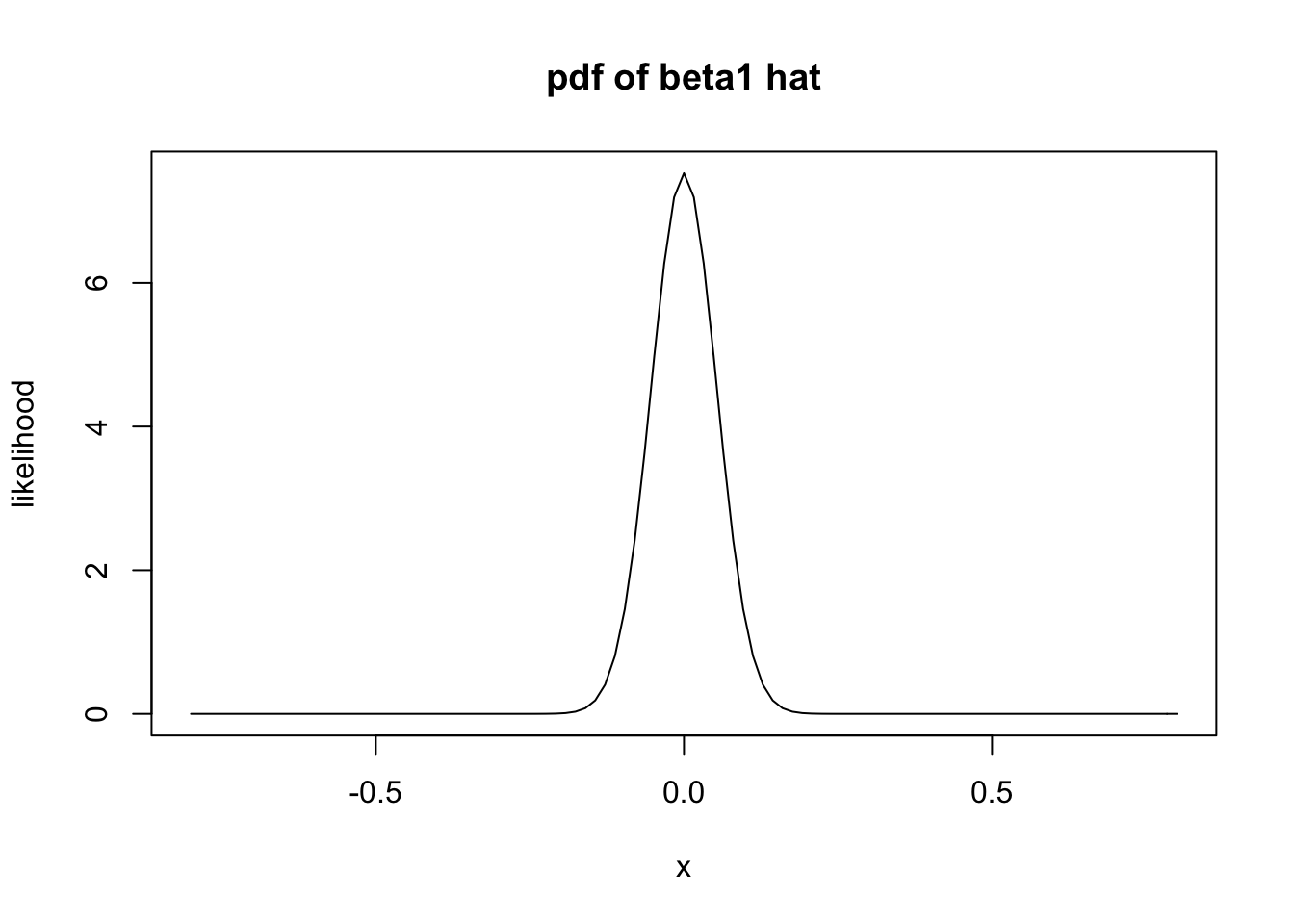

We need to assume, at this point, that the variance of \(\epsilon_i\) is known. We will see below what to do when it is not known. We assume that the variance is 1/2, so that the standard deviation is \(1/\sqrt{2} \approx 0.71\). Recall that \(\hat \beta_1\) is normal with mean \(\beta_1\) and standard deviation \(\sqrt{\frac{n\sigma^2}{n \sum x_i^2 - \sum x_i \sum x_i}}\). In this case, \(n = 127\) and \(\sigma^2 = 1/2.\) Therefore, the standard deviation of \(\hat \beta_1\) is

Under the null hypothesis, we have that the mean of \(\hat \beta_1\) is 0. So, if the null hypothesis is true, then \(\hat \beta_1\) is normal with mean 0 and standard deviation about 0.053. Let’s plot the pdf.

It is very unlikely that the computed slope would be 0.705 or larger! The \(p\)-value is obtained by computing the probability of getting 0.705 or larger given that \(H_0\) is true.

## [1] 1.1285e-40Wow! To be fair, we would also want to see the probability of getting less than -0.705, and add it to the above.

## [1] 2.257e-40Our \(p\)-value is \(2.257 \times 10^{-40}\). We reject \(H_0\) and conclude that the slope is not zero.

That’s all well and good, but… We don’t know what \(\sigma\) is at all in this setting. We need to figure out how to estimate \(\sigma\), and we need to figure out how that affects our \(p\)-value computation!!

We start with figuring out how to estimate \(\sigma^2\). Let’s suppose that our data comes from \(y_i = 1 + 2 * x_i + \epsilon_i\), where \(\epsilon_i\) is normal with mean 0 and standard deviation 3. We don’t assume that we know any of that information. But, if we did know \(\beta_0 = 1\) and \(\beta_1 = 2\), then we could compute \(y_i - (1 + 2 * x_i)\), and that would be a random sample from \(\epsilon\)! We could use sd to estimate the standard deviation or var to estimate the variance! Our idea, then, is to estimate \(\hat \beta_0\) and \(\hat \beta_1\), and then \(y_i - (\hat \beta_0 + \hat \beta_1 x_i)\) is an estimate of a sample from \(\epsilon_i\)! Maybe a good estimate for \(\sigma^2\) would be to use var on that!

Notationally, we call \(y_i - (\hat \beta_0 + \hat \beta_1 x_i)\) the residuals of the model.

xs <- runif(30, 0, 10)

ys <- 1 + 2 * xs + rnorm(30, 0, 3)

beta_0 <- lm(ys ~ xs)$coefficients[1]

beta_1 <- lm(ys ~ xs)$coefficients[2]

ys - (beta_0 + beta_1 * xs)## [1] 4.46467065 0.08499546 -0.36378462 1.01817529 -1.62147738 -1.59459005

## [7] -0.23029739 -1.84232401 -0.77976823 -0.49496992 0.15474083 1.63566834

## [13] 0.28086265 3.68654547 1.03698222 -2.08030854 1.28179026 -2.77744440

## [19] -1.48224806 -1.43190897 5.70679167 4.00498227 -5.48252712 -0.75660937

## [25] 2.08988494 4.61943655 -0.04992838 -2.73597589 -3.36872007 -2.97264420Now, to estimate \(\sigma^2\), we could use the var function.

## [1] 6.847442Let’s put this inside of replicate to see whether this is an unbiased estimator of \(\sigma^2\).

sim_data <- replicate(10000, {

ys <- 1 + 2 * xs + rnorm(30, 0, 3)

mod <- lm(ys ~ xs)

beta_0 <- mod$coefficients[1]

beta_1 <- mod$coefficients[2]

var(ys - (beta_0 + beta_1 * xs))

})

mean(sim_data)## [1] 8.649921Hmmm, it looks like it is too small. It can be provent hat estimating \(\sigma^2\) in this way is a biased way to do it. The formula for var is \(\frac {1}{n-1} \sum_{i = 1}^n (x_i - \overline{x})^2\). There is a rule of thumb that, for each parameter that you estimate, you need to subtract one from the \(n\) in the denominator in front of the sum. Since we are estimating \(\beta_0\) and \(\beta_1\), we would need to subtract 2 from \(n\). In other words, we need to multiple var by \(\frac {n-1}{n-2}\).

sim_data <- replicate(10000, {

ys <- 1 + 2 * xs + rnorm(30, 0, 3)

mod <- lm(ys ~ xs)

beta_0 <- mod$coefficients[1]

beta_1 <- mod$coefficients[2]

var(ys - (beta_0 + beta_1 * xs)) * 29/28

})

mean(sim_data)## [1] 8.932781That looks better! That is our unbiased estimator of \(\sigma^2\)! What kind of rv is \(\hat \sigma^2\), which is more commonly denoted \(S^2\). Well. \(S^2\) itself is not one that we are familiar with, but \((n - 2) S^2/\sigma^2\) is a \(\chi^2\) random variable with \(n - 2\) degrees of freedom.

Now, we are ready to do actual hypothesis testing on the slope without assuming that we know the underlying variance.

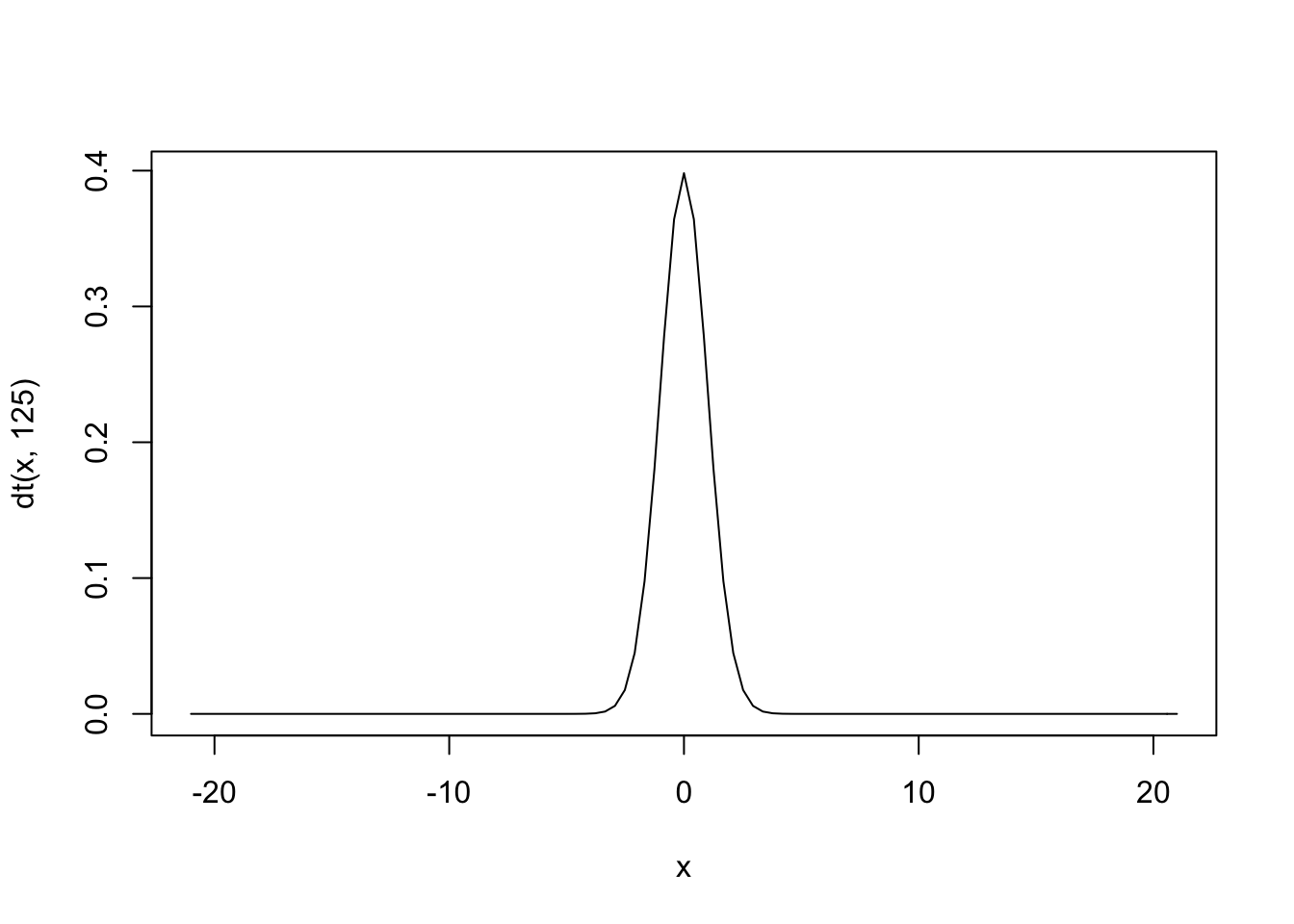

Theorem 2.4 Let \((x_1, y_1), \ldots, (x_n, y_n)\) be a random sample from the model \[ y_i = \beta_0 + \beta_1 x_i + \epsilon_i \] where \(\epsilon_i\) are iid normal random variables with mean 0 and variance \(\sigma^2\). Then, \[ \frac{\hat \beta_1 - \beta_1}{\sqrt{\frac{n S^2}{n \sum x_i^2 - \sum x_i \sum x_i}}} \] follows a \(t\) distribution with \(n - 2\) degrees of freedom.

To prove this, we will once again use simulations. We assume \(\beta_0 = 1\), \(\beta_1 = 2\) and \(\sigma = 3\).

n <- 30

sim_data <- replicate(10000, {

ys <- 1 + 2 * xs + rnorm(30, 0, 3)

mod <- lm(ys ~ xs)

beta_1 <- mod$coefficients[2]

a <- summary(mod)

(beta_1 - 2)/(sqrt(n * a$sigma^2/(n * sum(xs^2) - sum(xs)^2)))

})

plot(density(sim_data))

curve(dt(x, 28), add = T, col = 2)

We consider the happiness data set again. Our model is \(y_i = \beta_0 + beta_1 x_i + \epsilon_i\), where \(\epsilon_i\) are iid normal with mean 0 and variance \(\sigma^2\). The null hypothesis is \(H_0: \beta_1 = 0\) and the alternative is \(H_0: \beta_1 \not= 0\). Theorem 2.4 tells us that the test statistic

\[

\frac{\hat \beta_1 - \beta_1}{\sqrt{\frac{n S^2}{n \sum x_i^2 - \sum x_i \sum x_i}}}

\]

is \(t\) with 125 degrees of freedom, since there are 127 observations in happy.

We compute the value of the test statistic by putting in our estimate for \(\hat \beta_1\), which we can pull out of lm as 0.7046, and our estimate for \(S^2\).

mod <- lm(life_ladder ~ log_gdp_per_capita, data = happy)

beta_1_hat <- mod$coefficients[2]

S <- sqrt(var(mod$residuals) * 126/125)Therefore, the value of the test statistic is

## log_gdp_per_capita

## 13.08232That is, again, a very unlikely value for the test statistic that is \(t\) with any degrees of freedom!!

To compute the \(p\)-value, we use pt as follows:

## [1] 3.604795e-25And, we would reject the null hypothesis at any reasonable \(\alpha\) level. However, note that the \(p\)-value is 15 orders of magnitude greater than the \(p\)-value that we computed when we assumed that we knew \(\sigma\). That is quite substantial!

HistData::Galton that we looked at briefly. Assume the model \(y_i = \beta_0 + \beta_1 x_i + \epsilon_i\), and do a hypothesis test of \(H_0: \beta_1 = 1\) versus \(H_a: \beta_1 \not= 1\). Explain what this means in the context of the data.

2.5 Using different loss functions

In this section, we return to the model \[ y = \beta_0 + \beta_1 x + \epsilon \] where \(\epsilon\) is normal with mean 0 and variance \(\sigma^2\).

We show how to get values for \(\beta_0\) and \(\beta_1\) that minimize \[ \sum_{i = 1}^n g(y_i - (\beta_0 + \beta_1 x_i))^2 \] where \(g\) is even, \(g\) is decreasing for \(x \le 0\), and increasing for \(x \ge 0\). Examples of \(g\) were given above, such as \(g(x) = x^2\), \(g(x) = |x|\), or any of the 4 plots in the graph here.

curve(x^2, from = -4, to = 4, col = 1,

main = "Common Loss Functions") #black

curve(abs(x), add = T, col = 2) #red

delta <- 2

curve(delta^2 *(sqrt(1 + (x/delta)^2) - 1),

add= T,

col = 3) #green

curve(robustbase::Mchi(x, cc = 1.6, psi = "bisquare"),

add= T,

col = 4) #bue

Let’s find the values of \(\beta_0\) and \(\beta_1\) that minimize the \(L^1\) error, which is \[ \sum \bigl|y_i - (\beta_0 + \beta_1 x_i)| \] in the happiness data set. We will also compare that to the values we got using SSE. Recall that the data is stored in `happy.

As a reminder, we can get the SSE estimator for \(\beta_0\) and \(\beta_1\) via lm as follows.

##

## Call:

## lm(formula = life_ladder ~ log_gdp_per_capita, data = happy)

##

## Coefficients:

## (Intercept) log_gdp_per_capita

## -1.0285 0.7046The usage y ~ x is read as “y as described by x” and the response variable always comes first. The predictor(s) come after the ~.

Now let’s minimize the \(L^1\) error. We start by defining our loss function, \(g\).

Then, we define our total \(L^1\) error as

As before, we have to re-write this function to only accept a single argument because that is how optim works.

Now we are ready! We need to provide a guess to optim and the function we are minimizing. Let’s try a slope of 1 and an intercept of 0.

## $par

## [1] -0.8373535 0.6910757

##

## $value

## [1] 73.30576

##

## $counts

## function gradient

## 97 NA

##

## $convergence

## [1] 0

##

## $message

## NULLWe see that “the” line of best fit in this case is \(y = -0.837 0.691 x\) rather than \(y = -1.03 + 0.705 x\). I will leave it to you to decide whether the difference between those coefficients is meaningful. Let’s plot both lines.

ggplot(happy, aes(x = log_gdp_per_capita, y = life_ladder)) +

geom_point() +

geom_smooth(method = "lm", se = FALSE) + #SSE minimizer

geom_abline(slope = 0.691, intercept = -0.837)

What is happening? Well, when we look at the scatterplot, we see that there are some countries with abnormally low happiness for their gdp. The SSE worries about fitting those points more than the \(L^1\) error does, and the corresponding line that minimizes SSE is closer to those points that are kind of far away from the lines. This behavior can either be a feature or a bug for the method chosen. Or both.

Next up, we look at the psuedo-Huber loss function \(g(x) = \delta^2 \sqrt{1 + (x/\delta)^2} - \delta^2\). In this loss function, there is a parameter \(\delta\) that we can use to adjust the function. Let’s plot it for a few different values of \(\delta\).

curve(sqrt(1 + x^2) - 1, from = -5, to = 5, ylim = c(0, 5))

delta = .5

curve(delta^2 *sqrt(1 + x^2/delta^2) - delta^2, add= T, col = 2)

delta = 2

curve(delta^2 *sqrt(1 + x^2/delta^2) - delta^2, add = T, col = 3)

This loss function combines elements of both SSE and \(L^1\). When the error \(y_i - (\beta_0 + \beta_1 x_i)\) is small, we get behavior that looks like a quadratic \(g(x) = x^2\). When the error is large, \(g\) flattens out and looks like a straight line. When \(\delta\) is small, the loss function behaves like \(L^1\), and when \(\delta\) is big, it behaves like SSE.

This loss function is an attempt to strike a balance between the two methods that we have seen so far. With the set-up from above, we only need to change the function \(g\) to find the lines of best fit.

Now we can try this with a few different values of \(\delta\). Remember, when \(\delta\) is small, we expect to get results similar to what we got with \(L^1\), and when \(\delta\) is big, we expect to get similar to SSE, which as a reminder, were \(y = -0.837 0.691 x\) rather than \(y = -1.03 + 0.705 x\)

## $par

## [1] -0.8740431 0.6934752

##

## $value

## [1] 6.284509

##

## $counts

## function gradient

## 77 NA

##

## $convergence

## [1] 0

##

## $message

## NULL## $par

## [1] -1.0306062 0.7062522

##

## $value

## [1] 27.88364

##

## $counts

## function gradient

## 75 NA

##

## $convergence

## [1] 0

##

## $message

## NULLIndeed, we do get similar results, though not identical. If we are thinking of using this loss function, then we probably want to choose a value of \(\delta\) that gives results that are in-between the two extremes, in some sense. The package rlm automates this, not from the point of view of trying to always get something in between, but from the point of view of controling outlier effects.

## Call:

## rlm(formula = life_ladder ~ log_gdp_per_capita, data = happy,

## psi = MASS::psi.huber)

## Converged in 4 iterations

##

## Coefficients:

## (Intercept) log_gdp_per_capita

## -1.0560121 0.7091396

##

## Degrees of freedom: 127 total; 125 residual

## Scale estimate: 0.837We see that we don’

coefficients that are in between the two sets of coefficients that we computed previously. However, I believe that MASS implements the true Huber loss function, rather than the psuedo-Huber loss function that we implemented above so we aren’t really comparing apples to apples.

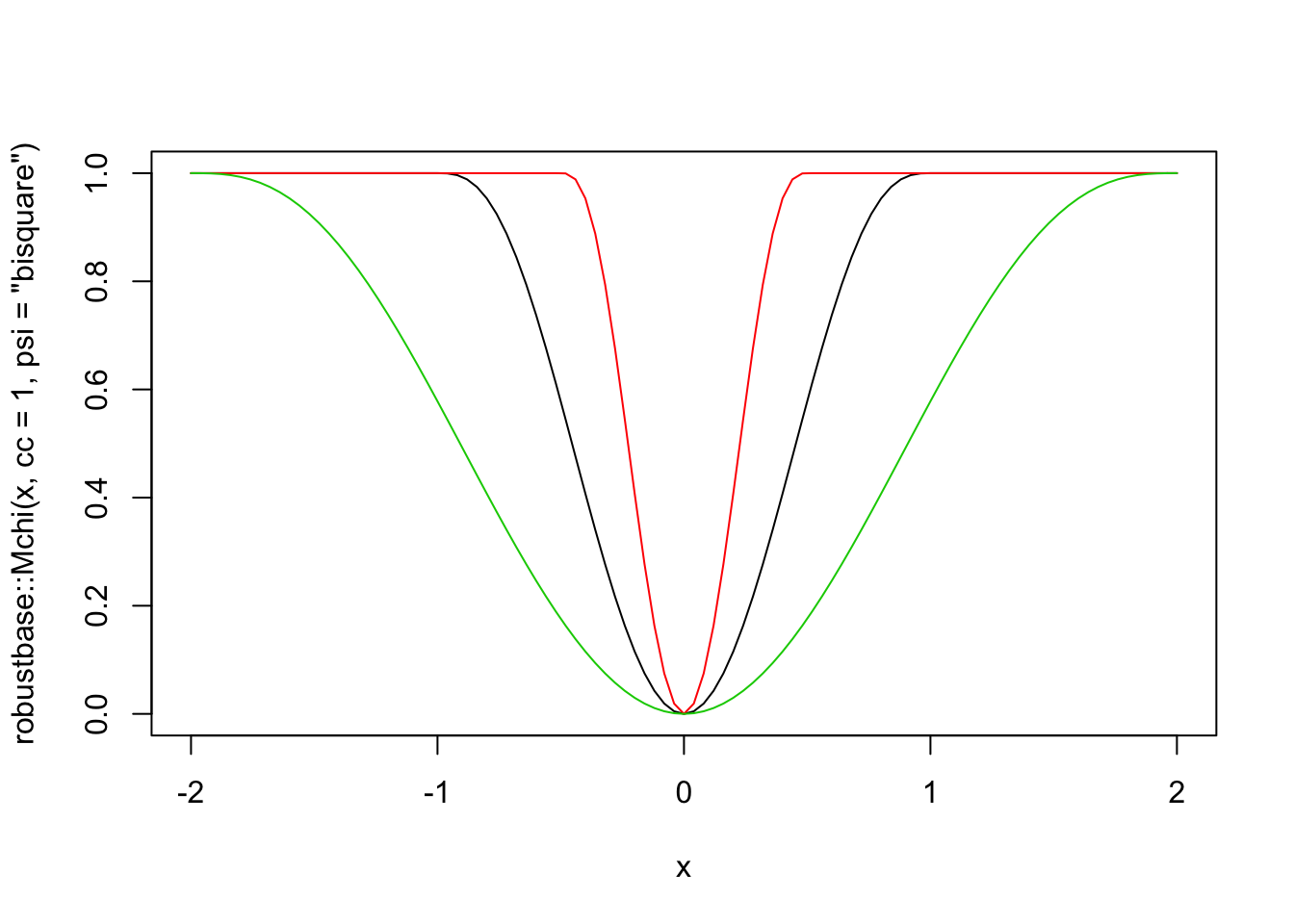

The rlm function also implements psi.bisquare, which is Tukey’s bi-square function. This loss function also has a parameter, which is denoted by cc in the robustbase package. Here are some plots.

curve(robustbase::Mchi(x, cc = 1, psi = "bisquare"), from = -2, to = 2)

curve(robustbase::Mchi(x, cc = 0.5, psi = "bisquare"), add = T, col = 2)

curve(robustbase::Mchi(x, cc = 2, psi = "bisquare"), add = T, col = 3)

The thing to know about this loss function is that for “small” errors, the loss function behaves like SSE. But, there is a maximum error allowed of 1, and the cc parameter gives the value of the raw error that corresponds to when the loss function starts equaling 1. In other words, if cc = 1, then all errors between observed and predicted that are bigger than 1 are penalized the same amount! This has the benefit of limiting the impact that a single (or multiple) outliers can have on the estimation of the line of best fit. Let’s first look at what happens with the happiness data, then we’ll switch over to simulated data.

##

## Attaching package: 'MASS'## The following object is masked from 'package:dplyr':

##

## select## Call:

## rlm(formula = life_ladder ~ log_gdp_per_capita, data = happy,

## psi = psi.bisquare)

## Converged in 4 iterations

##

## Coefficients:

## (Intercept) log_gdp_per_capita

## -1.0410932 0.7076074

##

## Degrees of freedom: 127 total; 125 residual

## Scale estimate: 0.839We don’ a big change by doing it like this.

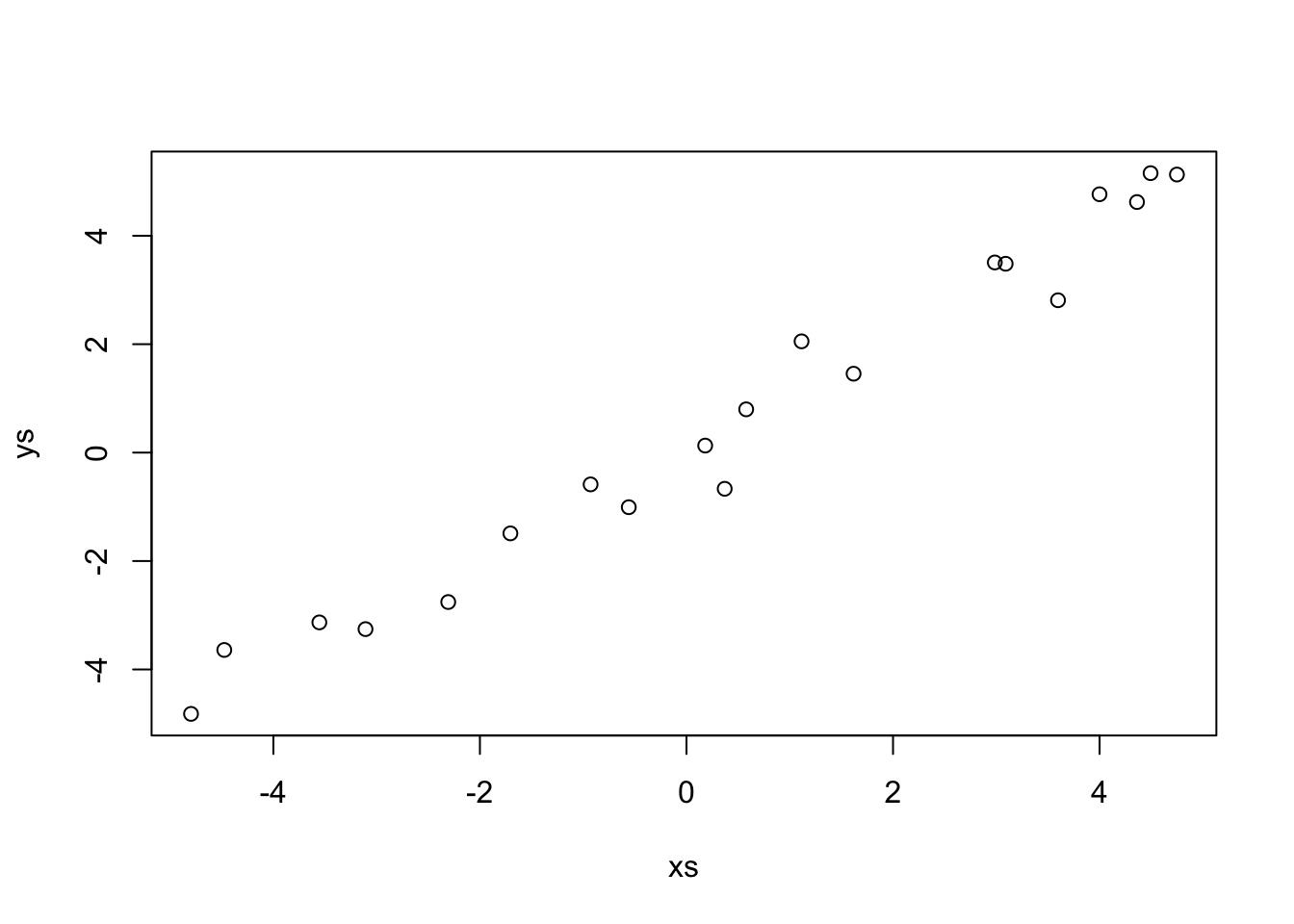

Now let’s set up a funky simulated data set.

This data looks a lot like \(y = x\). Indeed,

This data looks a lot like \(y = x\). Indeed,

##

## Call:

## lm(formula = ys ~ xs)

##

## Coefficients:

## (Intercept) xs

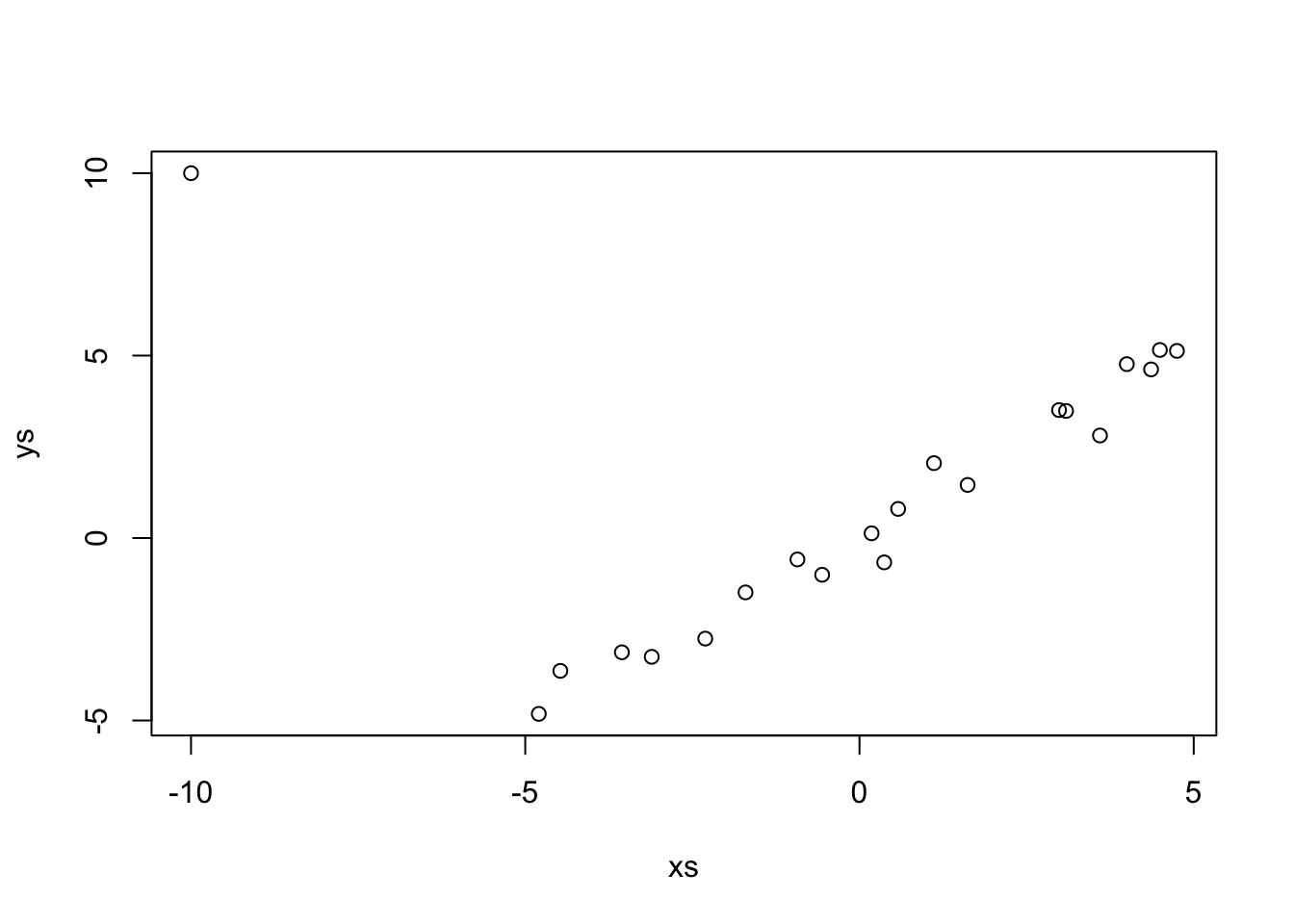

## 0.1318 1.0217Let’s see what happens when we add an outlier that changes it to look like possible \(y = -x\).

If we just use lm, which uses SSE.

##

## Call:

## lm(formula = ys ~ xs)

##

## Coefficients:

## (Intercept) xs

## 1.0784 0.3259

Repeat the above, replacing the outlier with successively bigger outliers, and see what happens to the line of best fit. Convince yourself that when the outlier is big enough, the line of best fit is perpendicular to the original line.

##

## Call:

## lm(formula = ys ~ xs)

##

## Coefficients:

## (Intercept) xs

## 1.3900 -0.3265When you are done using MASS, I always recommend detaching it. The reason is that MASS has a function called select that masks dplyr::select if we load MASS after loading dplyr.

2.6 Exercises

Let \(X_1, \ldots, X_5\) be normal random variables with means \(1, 2, 3, 4, 5\) and variances \(1, 4, 9, 16, 25\).

What kind of rv is \(\overline{X}\)? Include the values of any parameters.

Use simulation to plot the pdf of \(\overline{X}\) and confirm your answer to part 1.

Consider the data set

ISwR::bp.obese. If you have never installed theISwRpackage, you will need to runinstall.packages("ISwR")before accessing this data set.Find the line of best fit for modeling blood pressure versus obesity by minimizing the SSE.

Does it appear that the model \(y = \beta_0 + \beta_1 x + epsilon\), where \(y\) is bp, \(x\) is obese, and \(\epsilon\) is normal with mean 0 and standard deviation \(\sigma\) is correct for this data?

Suppose you wish to model data \((x_1, y_1), \ldots, (x_n, y_n)\) by \[ y_i = \beta_0 + x_i + \epsilon_i \] \(\epsilon_i\) are iid normal with mean 0 and standard deviation \(\sigma\).

Find the \(\beta_0\) that minimizes the SSE, \(\sum(y_i - (\beta_0 + x_i))^2\) in terms of \(x_i\) and \(y_i\). Call this estimator \(\hat \beta_0\).

What kind of random variable is \(\hat \beta_0\)? Be sure to include both its mean and standard deviation or variance (in terms of the \(x_i\)).

Verify your answer via simulation when the true relationship is \(y = 2 + x + \epsilon\), where \(\epsilon\) is normal with mean 0 and standard deviation 1.

Consider the data set

HistData::Galtonthat we looked at briefly. Assume the model \(y_i = \beta_0 + \beta_1 x_i + \epsilon_i\), and do a hypothesis test of \(H_0: \beta_1 = 1\) versus \(H_a: \beta_1 \not= 1\). Explain what this means in the context of the data.Consider your model \(y_i = \beta_0 + x_i + \epsilon_i\), where \(\epsilon_i\) are independent normal random variables with mean 0 and standard deviation \(\sigma\). You showed above that \(\hat \beta_0 = \overline{y} - \overline{x}\) is normal with mean \(\beta_0\) and standard deviation \(\sigma/\sqrt{n}\).

Fix a value of \(\beta_0\) and \(\sigma\). The residuals are \(y_i - \hat \beta_0 - x_i\). Find an unbiased estimator for \(\sigma^2\) in terms of the residuals. Call this estimator \(S^2\).

What kind of random variable is \(\frac{\hat \beta_0 - \beta_0}{\sigma/\sqrt{n}}\)?

What kind of random variable is \(\frac{\hat \beta_0 - \beta_0}{S/\sqrt{n}}\)?

Download the data

problem_2_5.csvhere. Model \(ys \sim \beta_0 + xs + \epsilon\) and perform a hypothesis test of \(H_0: \beta_0 = 2\) versus \(H_a: \beta_0 \not= 2\) at the \(\alpha = .05\) level.

Consider the data set

carData::Davis. This data set gives the recorded weight and the self-reported weight for about 200 patients. We are interested in modelingweightas a function ofrepwt.Confirm that there is an outlier in this data set. Do not fix the outlier.

Find the line of best fit using SSE, using the Huber or psuedo-Huber loss function, and using the Tukey bisquare loss function. Comment.